Overview

Adding AbleTrend to a Chart

Entry & Exit Rules

Best Practices for Page Configuration

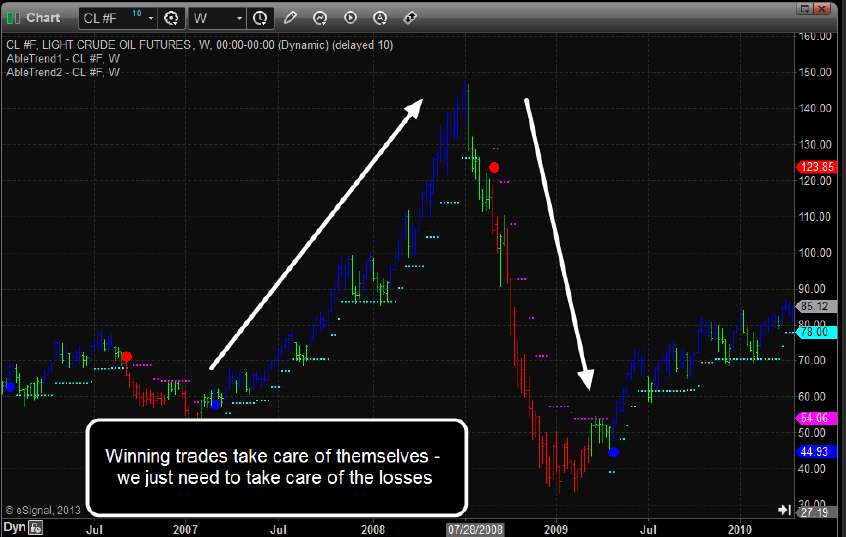

Thinking Risk & Reward

How to Leverage the Big Picture

Dealing with Choppy Markets

Support

Close eSignal and run the following: http://www.wintick.com/files/eSignal_Add/SetupAESAddOn.exe

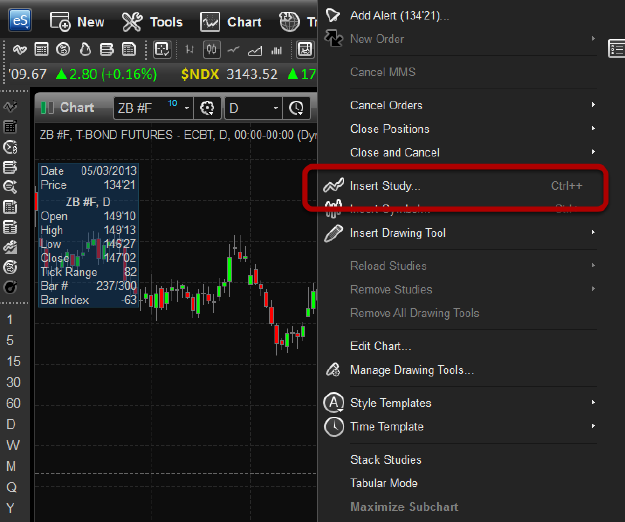

AbleTrend is seamlessly integrated as an add-on study. Simply right-click on a new or existing chart and select Insert Study.

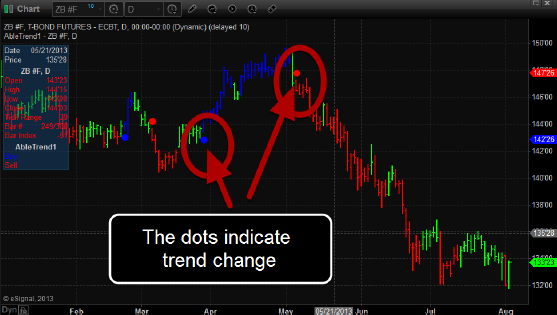

1. Buy when you have a blue bar with small light blue dot.

2. Sell short when you have a red bar with small pink dot.

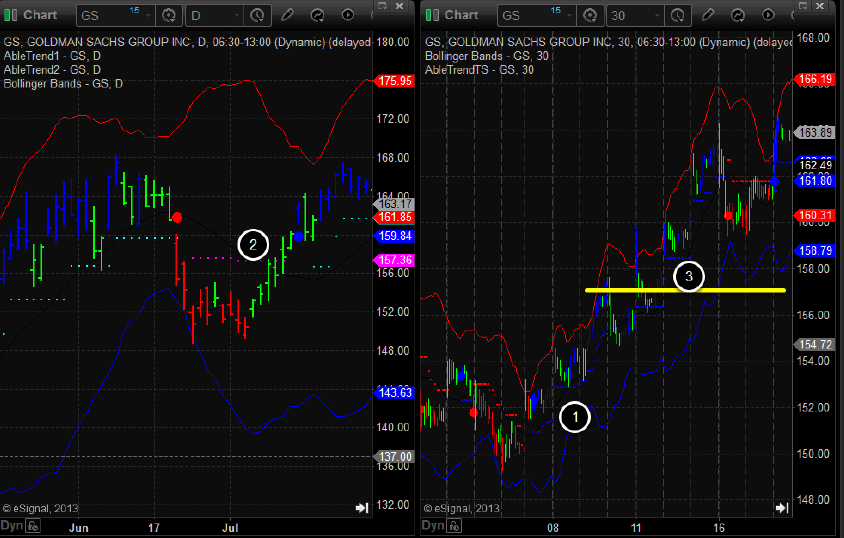

In the example, we have agreement for a long position (1), and agreement for a short position (2). At point 3, we see AbleTrend1 turn blue, but the small light blue dot does not come till later, so there is no agreement (3).

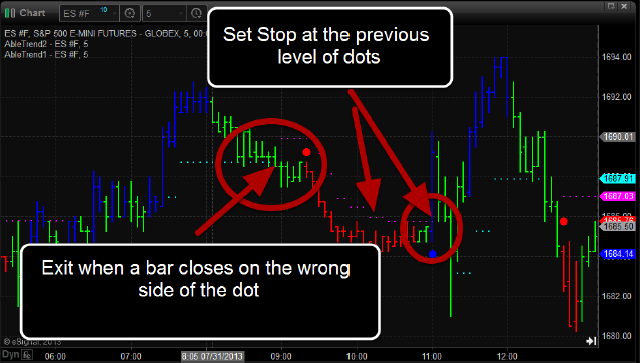

(1) The bar closes above the pink resistance dot or below the light blue support dot.

(2) If the price goes back to the previous level dots, there is a good chance it will not close on the right side of the dots. You may set a stop at the previous level of dots to limit risk while the current bar is forming.

As the trade unfolds, you can either see the trend end with a close that breaks support/resistance, or you can be stopped out at the previous level of dots. If neither occurs, the trend is likely on its way.

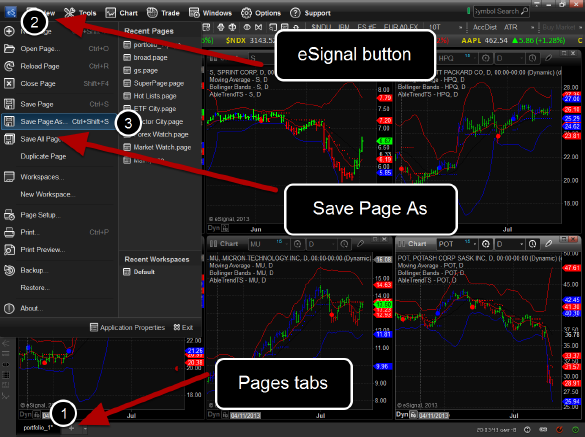

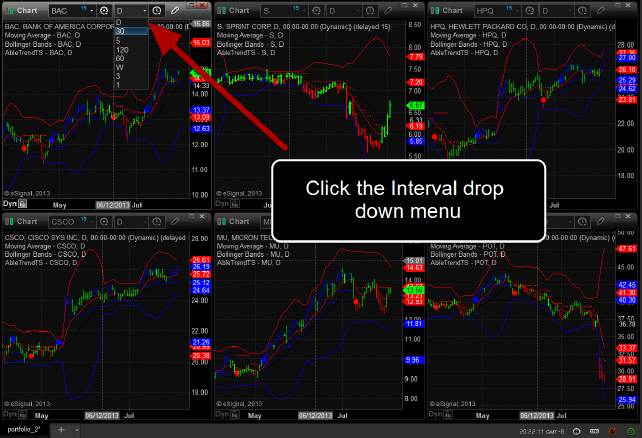

1. Portfolio - for monitoring a basket of products at-a-glance. Typically, each chart will follow different products using the same analysis template & time frame.

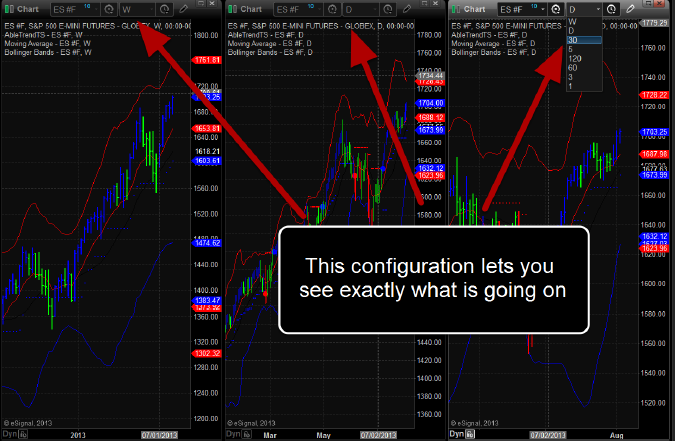

2. Trading Analysis - for making specific trading decisions & leveraging the big picture. Typically, it will be a page that follows one symbol using two or three time frames.

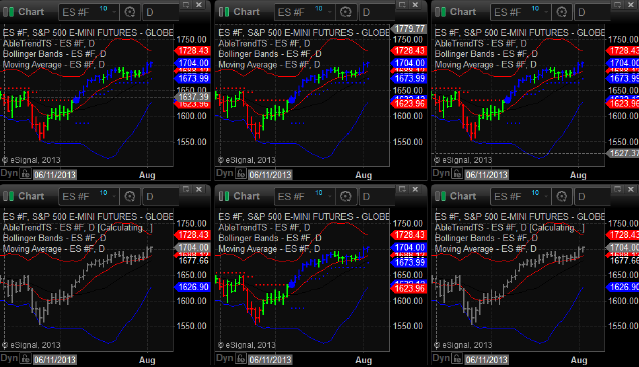

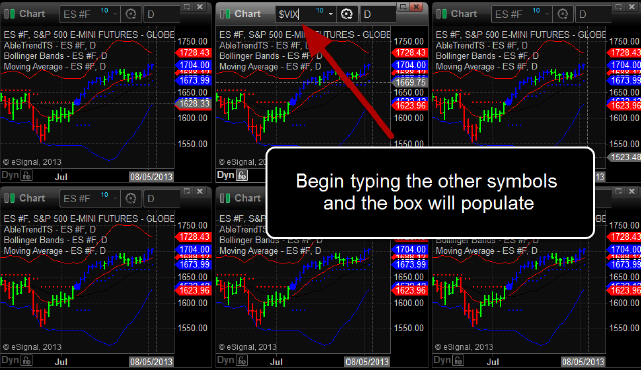

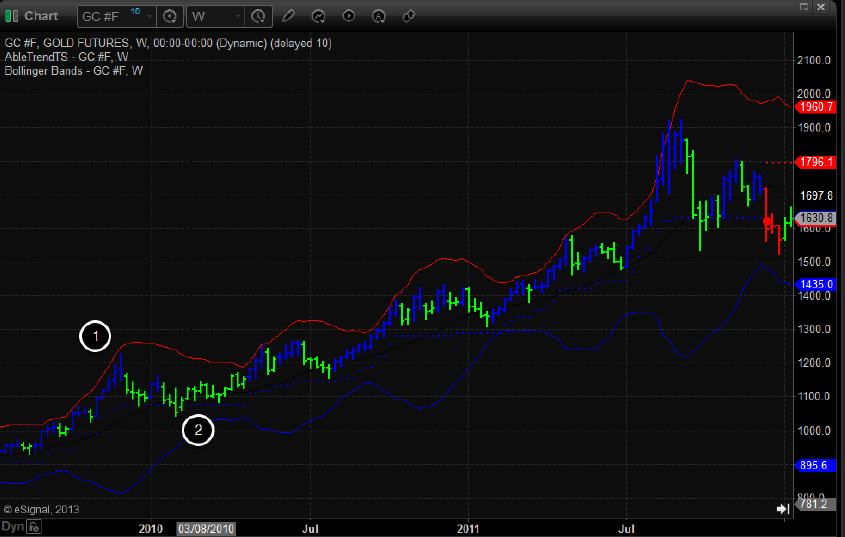

Start by configuring a chart with the analysis template you'd like to use. In the example, we have AbleTrend along with a 10 period exponential moving average, and 3 deviation Bollinger Bands (We will explain why in the next section).

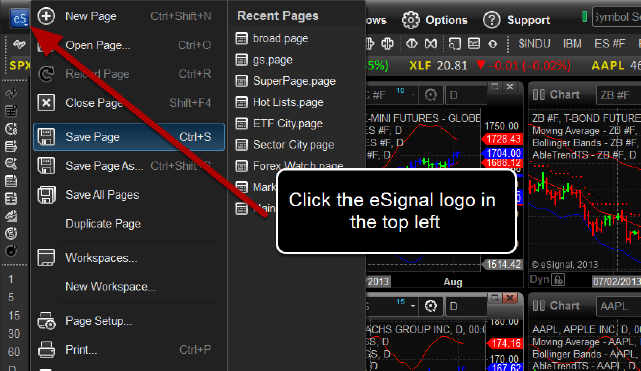

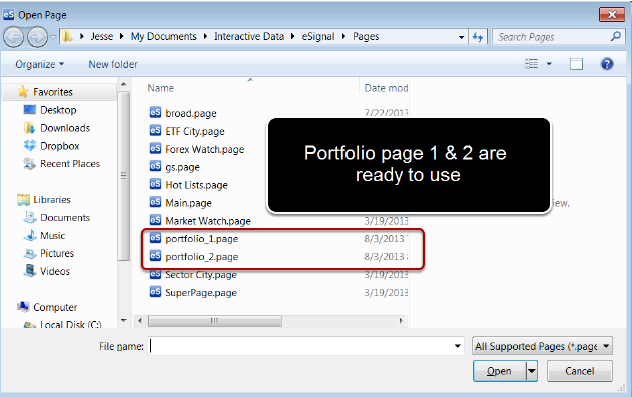

The easiest way to continue creating pages is to work off of the pages you already have. Just change the symbols and then click the eS icon (2), and Save As (3).

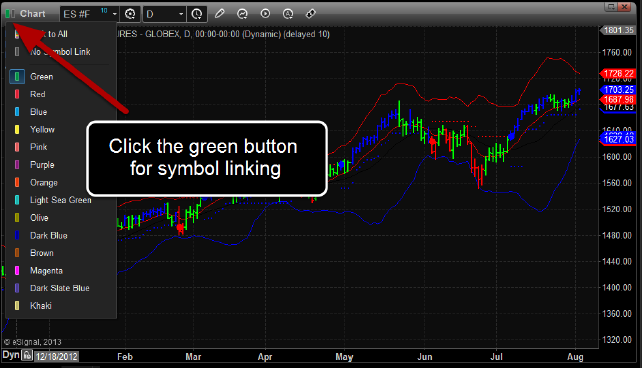

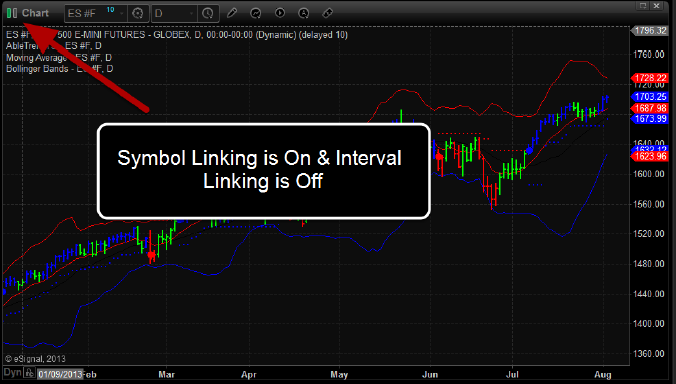

Starting with a new page, configure your chart the way you like it and make sure Symbol Linking is on and that Interval Linking is off. Duplicate once or twice for a total of two or three charts.

Since we require a support or resistance level to initiate a trade, we always know where we'd get out if we were wrong.

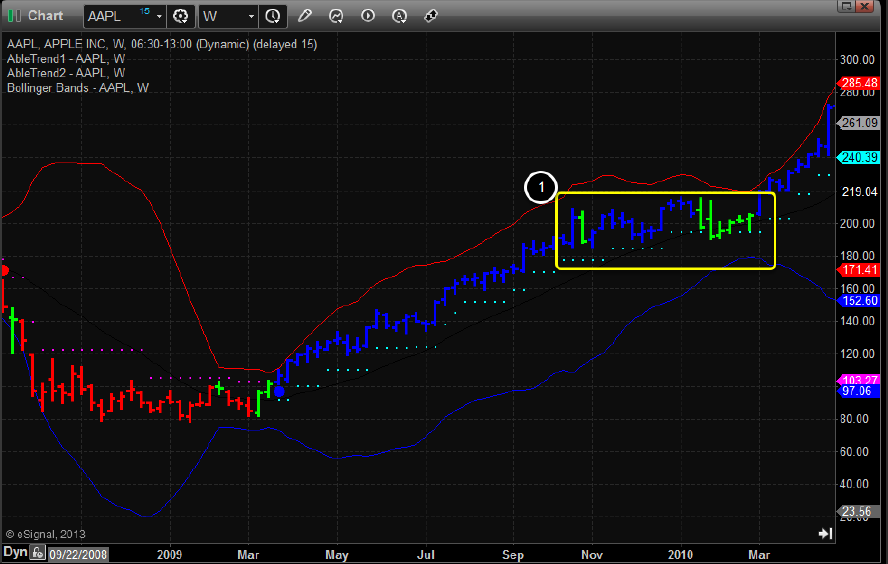

If the distance to support/resistance is initially very big, the risk for the trade is also greater. Many times, you will find that AbleTrend defines the points so well, that the price comes right down to the dot and bounces off it. (1)

Since there are so many opportunities, you don't need to make it difficult for yourself. An easier entry is after the market has finished testing support or resistance, and is still very close. (2) This is a better time to enter.

Once the dots exceed your entry price, the trade becomes a winner (2). Even if the trend fails to continue, you will most likely be able to cash the trade or break even.

That's how we can really let our winners run, and let the market take care of the profit (3). As the trend continues, the dots continue you to help you secure more and more profit!

Taking Profits

because we've seen that trends can go far further than we could imagine when a trade starts, we get the biggest benefit from securing profits along the way rather than setting targets. There are however, two situations where we may seek to take some profit off the table.

1. Recent highs/lows

2. Prices exceeding Bollinger Bands/Starc Bands

Prices can go in the right direction to begin with (1), reach the recent high/low (2), and then turn around and either reverse or go into congestion. That's this is the most common place for new traders to get shaken out of a trend, when they were 100% correct about the market direction.

When initiating a trade, you want to have ample room for prices to go before reaching that significant point. More importantly, since the risk comes out of the trade as prices go in the right direction, we'd be in a very favorable position to deal with the price struggle if we've got a bit of profit in the trade, and have either a very limited amount of risk or no risk left in the trade. This is the more robust of the two - something that every one can see. Ideally, we want to be positioned for a fast break out, but to have the risk managed out of the trade for less favorable outcomes.

STARC Bands and Bollinger Bands are dynamically calculated and will move with the price, but we want to ensure that we aren't likely to trade into a pullback before seeing profit. (1) At the outset of a trade, you want to see that there is some room for prices to move. (2)

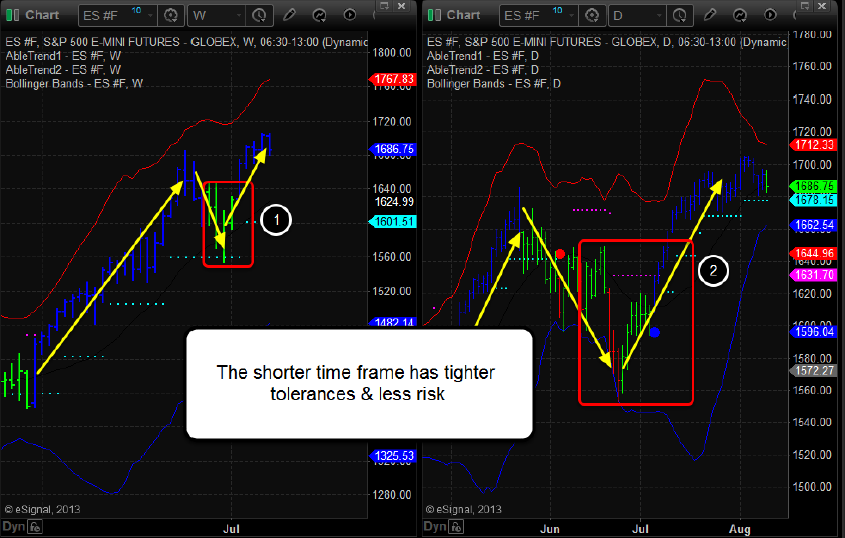

We want the most favorable risk to reward. By trading the long term trend at the lowest risk points, you can further constrain risk by leveraging the short term trend change to get in.

Here AbleTrend is applied to a Weekly and a Daily chart. We are looking at the same information from different perspectives. Our bread and butter trade leverages the major trend (1), but manages risk initially with tighter tolerances (2).

Is there any obstruction or is there an open runway?

Recent highs and lows can obstruct a trend, at least temporarily, as well as less obvious support/resistance.

The swing trade example provided below picks up after the long term uptrend finished testing AbleTrend T2 support.

Here's how to read it:

Our buy signal comes in on our 30min chart at 152.00, with support below around 150.00 (1). That is the initial risk Our intermediate time frame, Daily chart still shows resistance at that time at 157.36 (2) Beyond that, we have highs above 168.00

We have a setup with a little over 2 points that we're thinking of as risk, and about 5 points for prices to move before reaching resistance.

Next, there are 3 outcomes if we buy:

1. The long term trend does not continue, and we immediately see the trade is wrong, exit and give up a couple points

2. Prices can begin to go in the right direction, but fails to continue

3. Prices can find resistance, break and the trend resumes

Our trade consideration is focused on the 2nd outcome, and what is happening with the support dots on your trading time frame. At the critical testing points, the market will never make it easy to stay in the position (3).

We want to think about how we can be well positioned for those crucial testing points. If prices get there, like we see in the example, it is less stressful to be involved if the support dot is already 4 points above where you took the trade.

We favor trade setups where we are trading with the major trend, but there are also good opportunities before the market reverses. The key is to do the same risk/reward comparison.

Seeking to catch the trend provides us with a winning framework, including all the winning/losing trades, however when congestion makes itself apparent, we can react.

Recognizing Choppy Markets

Losses during choppy markets are smaller than the gains when the market is trending, but there can be a long succession of trades.

While choppy markets do not announce themselves ahead of time, we can recognize chop once there have been two consecutive trends that have not followed through.

How to deal with choppy markets

There are two courses of action:

1. Stop trading. When we recognize chop, the ultimate hedge is to stop trading that product. There are plenty of opportunities out there, we do not have to insist on trading one product

2. Trade down to a shorter time frame - If the trading range is wide enough, there can be money making opportunities trading up and down in the range. Look for the short term trends to reverse near the tops and bottoms

When the daily chart is untradeable, the 30 min signals help you to trade and manage risk. The risk/reward consideration is almost the same. Trading to the other end of the trading range, if the reward/risk is better than 2 or 3, the trade may still be worth trading.

For day traders, the intraday trading ranges in choppy markets are usually not worth the time and risk.