Subscription Guide for the Arps Scan Sentry Tool Kit

How to Apply the Tools to a Watch List Window

How to Link a Watch List Window to a Chart Window

The Arps Scan Sentry Tools

Arps TTB Flags

Arps TTB Pullback 23

Arps TTB Trender Pullback

Arps TTB Trend Exhaustion 1(R2)

Overview

Ideally, the most efficient way to locate attractive trading opportunities among a large number of symbols is to scan and sort that list of symbols according to the analysis of sophisticated tools designed to identify key price patterns or technical behavior. The unique Scan Sentry™ tools provide a matrix of easy-to-interpret color-coded information about key elements of behavior for hundreds of symbols at one time. You can set the Watch List to work with any kind of data including tick, intraday, daily, weekly, or monthly intervals and you can tweak the performance by adjusting various input values through the tools’ Inputs window.

Subscription Guide for the Arps Scan Sentry Tool Kit

The Arps Scan Sentry Tool Kit on eSignal is available on a lease basis. The lease is $50 per month. You can add the lease to your eSignal account directly on your eSignal platform by clicking here. Or, you can contact an eSignal representative.

2. Right-click on any column header.

3. Click on Add Columns.

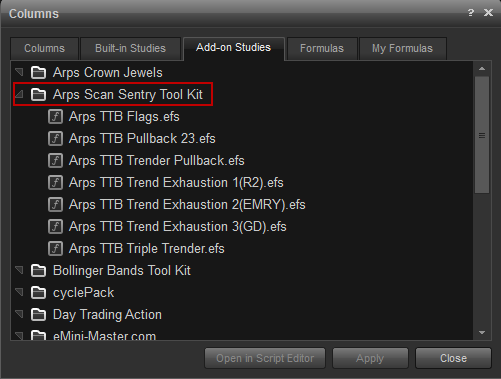

4. Click on the Add-on Studies tab and select the Arps Scan Sentry Tool Kit folder.

6. Click on Close.

How to check or change the Time Interval

The Watch List column title displays the timeframe that is currently selected. The eSignal Watch List works on any timeframe- tick, volume, minute, daily, etc. The data is updated end-of-bar only to avoid overloading the Watch List due to the large amount of data.

For indicators that have multiple output columns, the timeframe is displayed in each column title. To change the applicable timeframe, right-click anywhere in the Watch List column header and click Edit Columns. Then highlight and click on the scanning indicator you want to change the interval for. Then click on the clock icon in the “Interval” input and select your new interval. You will need to do this for each scanning indicator.

For synchronized signals on your linked charts, please remember to change the chart interval to match the Watch List interval. Otherwise the indicator readings on the Watch List will not match the chart.

You can display multiple time intervals in the same Watch List window by inserting the TTB indicator again for each additional interval. After inserting the TTB study, go to the Inputs screen and change the first Input “Interval” to the additional interval. The TTB indicator column title displays the timeframe to help you distinguish between multiple timeframes.

How to change and format the Scan Sentry indicator inputs

Most of the Scan Sentry Tool Kit indicators contain inputs called "Parameters" on the eSignal platform. When you apply the indicators to an eSignal Watch List window, you can either use the default values or you can change the values. Each indicator and its inputs are described in detail in the descriptions below.

How to Link a Watch List window to a Chart Window

Subscribing to the Companion Charting Tools:

The companion charting tools described in this document are included in the Arps Crown Jewels lease. When you subscribe to the Arps Scan Sentry Tool Kit on eSignal, you receive access to the scanning tools only. The Arps Crown Jewels lease is $20 for the first month, then $95 each month thereafter.

Companion charting tools included in the Arps Crown Jewels lease:

Arps Triple Trender

2. In the upper top right of each Watch List and chart window are two small vertical bars. The one to the left is for “Symbol Linking” and the one to the right is for “Interval Linking”. Click on both bars in both windows to activate linking.

1) Right click in the chart window

2) Click on Edit Chart.

Arps TTB Flags

Many times a trending market will pause from its major trend to form a short-term correction pattern known as a “flag” pattern. Flag patterns can be subdivided into Bull Flags, a consolidation in an uptrend, and Bear Flags, a consolidation in a downtrend. These patterns usually form near the midpoint of a steep, quick price trend. The Arps Flag Pattern tools highlight bull and bear flag patterns that will help you to find potentially profitable breakouts from trend consolidation formations.

Cells are color-coded and user defined, default settings are: Light Green for bull flag setup. Dark Green for bull flag breakout Magenta for bear flag setup Red for bear flag breakout.

Breakout Price: Displays the price the stock must reach to confirm a breakout of the flag pattern.

Target: Displays the price at which the Profit Target will be achieved for the current flag pattern. The price will match the user-controlled input settings for the chart indicator on the size of flags and profitability targets you wish to trade.

Flg % to TGT: Displays in percentage terms where current price is in relation to the distance from the breakout price to the target price. The Percent to Target column, “% TO TGT”, will be blank until a breakout has occurred. At the breakout price the % TO TGT cell will show 0%. When price reaches the target, the % TO TGT cell will show 100%. If price is half way to the target from the breakout price, for example, the cell will display 50%.

To look for the most recent flag patterns, we double click on the header of the “Bars Ago” column and the symbol list is then sorted with the most recently occurring flag patterns at the top. For a daily time frame, “0” Bars Ago indicates that a flag pattern has formed today, “1” Bars Ago would indicate a flag pattern formed yesterday, and so on. Similarly, if you were to format the Symbol column to display 5-minute data, “0” Bars Ago would indicate the current 5-minute bar and “1” Bars Ago would indicate that the flag pattern was identified on the previous 5-minute bar. The Bars Ago column will reset to zero when the price closes across the ‘Flag Breakout Price’ thus confirming the flag pattern.

As mentioned above, by double-clicking on the column header “Bars Ago”, the scanner will sort the most recently detected flag patterns to the top of the list in descending order, starting with those detected in the current bar, bar “0”. Using a linked chart window with the Arps Flag chart indicator applied, we then click on any symbol of interest in the scanner Symbol column for further analysis.

The TTB Flags Scanner, in addition to highlighting recent flag patterns and flag breakout signals, is useful in tracking the progression and maturity of flag pattern breakouts. In some cases, like with any strong trend, you may wish to participate in a breakout after the early stage.

Inputs

Minimum Pole Bars: The minimum number of bars in a flagpole

Minimum Flag Bars: The minimum number of bars in a flag

Bars to Disable Breakout: If a breakout doesn’t occur within this number of bars after the flag has been identified, the flag breakout is no longer valid.

Max Pullback Percent: The number of points in the pullback from the flag high to the flag low cannot exceed this percent of the length of the pole, i.e., maximum percentage retracement of flag to flagpole

Enable Volume Filter?: When checked, it turns on an additional filter to require the volume in at least one bar of the flag pullback to be lower than the average volume over the last 50 bars. (The volume nearly always recedes over the course of a flag formation.)

Target Multiplier: The indicator plots a target line at a distance equal to the length of the flag pole once a valid breakout has occurred. To increase or decrease the target distance, insert a number greater or less than 1, such as .5 or 1.5.

This tool monitors any chart in real time, on any time frame, for a specific combination of forces to be applied to the price action. It looks from several unique perspectives for those rare occasions when certain patterns are aligned together like a contrapuntal choir of harmonious voices. When this infrequent but synchronous event appears, you are alerted with a labeled “PB23” dot on the chart and, if enabled, an alert on your screen or e-mail as well. These are powerful setups which, when they do occasionally come into alignment, provide excellent opportunities for early trend re-entry or short term profit scalping. The Arps Pullback 23 tool also includes an optional exit indicator which you can toggle on or off depending on your trading style.

Inputs

Bass: (1-40) Higher numbers provide later but more reliable signals.

Tempo: (10-50) Lower numbers will generally find fewer but more reliable opportunities.

Chromatic: (0-5) Don't be afraid to fine tune this one with decimals.

Show_Exit: Check if you want the tool show you the exit signals for this setup.

Show_Bullish: Check to show bullish signals.

Show_Bearish: Check to show bearish signals.

Show_Setup: Check to plot setup signals on your chart.

Up Color: (blue) Choose any color name your charting platform recognizes.

Down Color: (red) Choose any color name your charting platform recognizes.

Arps Trend Exhaustion Charting and Scanning Tools with Optional Early Warning Signals

Each Arps Trend Exhaustion tool, both charting and scanning versions, comes equipped with our new “Early Warning Signals Option” designed exclusively by Jan Arps’ Traders Toolbox to improve your trading execution and timing, vital keys to gaining an edge in the quest for consistent trading success.

Getting into and out of a good trading opportunity is not always easy to accomplish. Timing and selection are of paramount importance when it comes to making money in today's markets. Getting into a trade at the beginning of a trend and exiting near the end of that trend is the goal of most successful traders. But how do we know when those price opportunities arise? Well, decades of market experience, technical analysis study, and improved capabilities in some of today's most popular trading platforms have led us to devise the Trend Exhaustion tools. These studies use sophisticated proprietary market analysis to indicate, with colored dots plotted above or below price bars in real time, trend exhaustion signals which can alert the savvy trader to high probability entry and exit opportunities. They have been designed with simple user input parameters in order to be applicable to many different types of markets and time-frames. Therefore, you should apply these tools to your charts and explore the input settings to find the combinations which suit your particular trading style, chart resolution, and market.

The Arps Trend Exhaustion tools present three unique ways of analyzing current market conditions for potential exhaustion of a trend. The TE1 tool (Arps Trend Exhaustion 1) looks at price action, TE2 (Arps Trend Exhaustion 2) looks at price patterns, and TE3 (Arps Trend Exhaustion 3) looks at a combination of factors combining unique proprietary indicator patterns with chart patterns. The Trend Exhaustion suite of tools also includes our powerful pullback identifier, the Arps Pullback 23, to highlight pullbacks in a trend. All of the Trend Exhaustion tools are now included in the Arps Crown Jewels package for eSignal and are now available as a part of the Arps Scan Sentry Toolkit for the eSignal Watchlist.

One of the key features in these Arps Trend Exhaustion charting and spreadsheet tools is the unique optional ability of the tools to identify their setup process in real time. This enables you to get ‘early-warning’ signals as the combination of signal conditions come into alignment.

Warning Signals are generated when a trend exhaustion condition is imminent, but not yet confirmed. The Charting versions of the Arps Trend Exhaustion Tools plot a small (color user controllable) “+”when a setup is pending. The symbol is located above the bar high if an uptrend exhaustion is setting up and below the bar low if a downtrend exhaustion is setting up.

For the scanner versions of the Trend Exhaustion Tool, we have created a separate column called “WARNING”. When a warning setup is detected, that particular cell turns yellow and contains the letters “Up” or “Dn”, depending on the direction of the warning. It will also generate an optional alert when this occurs. The yellow colored cell disappears on the next bar, unless a continuing setup is detected. So, when a yellow cell appears in the scanner for a particular TE indicator, the user is alerted to its presence by an alert signal and he can then monitor the chart in anticipation of a confirmed signal on a subsequent bar.

The Arps Trend Exhaustion 1(R2) tool uses the Arps Radar 2 Price Acceleration Oscillator to study the nature of price action to recognize internal signals which often lead to price reversals on the chart. One of Jan Arps' most popular tools, Radar 2 is based on a proprietary algorithm which looks for subtle changes in the behavior of the price to detect changes in strength or weakness of the trend, which is confirmed by a cross of the FastLens and SlowLens lines. TE-1 can be successfully utilized in the manner of many typical oscillators, by monitoring for a cross below or above dynamic overbought or oversold zones. When such conditions exist this Trend Exhaustion tool plots a dot above or below the price and, like all of the Arps Trend Exhaustion tools, it can also send you an alert when it has recognized such an opportunity.

Early Warning System and Automatic OBOS Zone Components

When the input parameter “Use_Overbought/Oversold Cross?” is checked then the tool will automatically calculate dynamic overbought and oversold lines based on the volatility of the indicator over a user defined lookback period. When that parameter is NOT checked, then you can manually input your own Price Leader levels to define the overbought and oversold zones.

Since this tool is based on our Radar2 Price Acceleration indicator the “warning” signal is generated when the fast line converges toward the slow line. In order to generate a warning signal using OBOS mode, the fast line must be beyond the OBOS threshold and converging toward that threshold. If the fast line crosses the slow line before the fast line crosses the OBOS threshold, the tool will generate signals on the earlier cross of the oscillator lines.

1) Generate signals on automatically calculated OverBought/OverSold Zone crosses - check both the “Use_Overbought/Oversold Cross?”, and the “Automate Overbought/Oversold” input parameters.

2) Generate signals on manually calculated OverBought/OverSold Zone crosses - check the “Use_Overbought/Oversold Cross?”, and do not check the “Automate Overbought/Oversold” input parameters. Now you can manually input the OB Zone and OS Zone levels of your choice. Zero is a good option for this because it will provide signals when the fast Price Leader fast line moves from acceleration to deceleration.

3) Generate signals every time the Radar2 Price Leader fast line crosses the Slow Line- do not check “Use_Overbought/Oversold Cross?”. Price Leader fast/slow line crossing signals will display as “TE1” with the appropriate trend color.

Slow Lens Sensitivity: The Slow Lens of the Radar2 Price Leader. Lower settings tend to create more frequent signals.

Use_Overbought/Oversold Cross?: Check if you want to indicate a cross from an overbought or oversold threshold. Uncheck to indicate turning points in the oscillator.

Automate Overbought/Oversold?: Check to have automatic calculations of the OB and OS thresholds. Uncheck to input your own values for the OB and OS zones.

OBOS Lookback: The lookback period for the automatic OBOS calculations.

OBOS Sens: Sensitivity setting for the automatic OBOS calculations. Higher numbers will cause the OBOS zones to be farther away.

OverBought Zone: (0 to 300) Indicates the overbought threshold. Leave blank when using the Auto_OBOS_Zones. Input a number of your choosing when not using the auto OBOS zone calculator.

OverSold Zone: (0 to -300) Indicates the oversold threshold.

Show_Bullish: Set to true to display bullish signals

Show_Bearish: Set to true to display bearish signals

Up Color: (green) Use a color name your platform recognizes.

Down Color: (red) Use a color name your platform recognizes.

Early Warning System Component

This tool looks for Trend Exhaustion signals identified by specific price patterns. When some but not all of the conditions of those price patterns come about, the tool will generate a “warning” signal in the form of a cross.

Inputs

Resolution: (1-10) Generally lower numbers work better in trending markets and higher numbers in choppy markets.

Show_Bullish: Check to display bullish signals

Show_Bearish: Check to display bearish signals

Show_Setup: Check to display indicator signals

Up Color: (green) Use a color name your platform recognizes.

Down Color: (red) Use a color name your platform recognizes.

Plot Spacing: (1-10) Smaller numbers plot the dot closer to the high or low of the bar generating the signal.

Plot text: Check to display signal text on chart

The Arps Trend Exhaustion 3 tool takes a look at the market through the filter of several different concomitant proprietary analytical techniques, and plots its signals when enough of the indications agree on the likelihood that the current bar represents significant trend exhaustion. This tool is particularly adept at identifying possible swing points in real time providing you with timely exit warnings in trending markets.

Early Warning System Component

This tool looks for a confluence of chart patterns and indicator conditions. When some but not all of the requirements for the indicator conditions are met, then the tool will plot a “warning” signal in anticipation of the fulfilled Signal Dot conditions.

inputs

sensitivity: (2-75) typically lower numbers will produce fewer signals in a trending market.

show_bullish: check to display bullish signals

show_bearish: check to display bearish signals

show_setup: check to display indicator warning signals

plot spacing: (1-10) smaller numbers plot the show-me dot closer to the high or low of the bar generating the signal.

plot text: check to display signal text

Based on the volatility-sensitive Arps Trender operating across three separate time frames, the TTB Triple Trender scanning tool indicates the degree of trend congruency for all of the elements in the scanner list. The TTB Triple Trender indicates the current trend direction and strength with its color-coded cells, and the plotted numbers tell you how long it has been since the last significant change in trend direction for every given symbol in your list. It also calculates a “score” relative to the strength and direction of the short-term, medium-term, and long -term trend for each symbol. Furthermore, the TTB Triple Trender will point out those symbols whose score has changed up or down on the most recent bar interval, giving you a quick and clear indication of trading opportunities as they occur. Although the inputs allow you to use your own color schemes and sensitivity settings, this explanation will use the default values programmed into the indicator.

A green cell is in an uptrend.

The number in each Bars Ago column represents the number of bars since the last time the trend changed. In other words, if the trend “flipped” from down to up seven bars ago, the cell would be green and contain the number “7”. If the trend “flipped” from up to down three bars ago, the cell would be red and contain the number “3”. Note that the “Bars Ago” count does not change when the cell color changes from strongly upward trending dark green to the weaker uptrend indicated by the light green background plot of the cell. The same is true, of course, for the downward trending red and magenta plots. The count only changes when the trend has “flipped” from up to down or vice-verse.

The Percent Change column to each Trender indicates how much price has changed since the occurrence of each Trender flip. If you do not wish to view the “% CHG” column, or any other column for that matter, you can easily remove the individual columns from the Watch List by simply right-clicking on the header of the TTB Triple Trender indicator and then choosing “Remove column title name” from the drop-down menu.

The TTB Triple Trender scanner allows you to rank your list by the perceived strength of the trend. The column labeled “Score” indicates the overall strength of the trend up or down. It is calculated by applying the following arithmetic values to each color-coded cell.

2: dark green strongly trending bullish

1: light green weak bullish indications

-1: magenta weak bearish indications

-2 :red strongly trending bearish

A score of +6 would represent a strong overall uptrend for that symbol while a score of -6 would represent a strong overall down-trend. A neutral score of 0 would represent a symbol in sideways congestion. One of the great advantages of using a scanner of this type is that we can then arrange all of the symbols in order of overall strength or weakness. If we run a sort on the “Score” column by simply double clicking on the “Score” header we could display all the strong sixes together at the top of the column and all the weak minus sixes at the bottom of the column, thus sorting the symbols from the strongest to the weakest.

Additional information in regards to the Jan Arps Indicators or Custom Programming, can be found on the Jan Arps' Trader's Toolbox website.