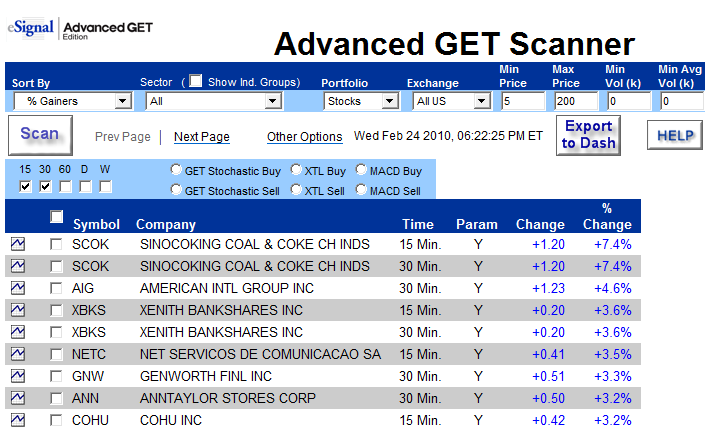

The Advanced GET Scanner searches the U.S. markets in real time for stocks poised to move. Find award-winning strategies such as Type One buys, XTL Breakouts or Type Two sells with a click of your mouse in seconds. Includes many pre-built sets and lets you combine any of a number of standard studies and indicators, including the ADX, DMI, MACD, stochastics, etc.

- List retrieval from the entire U.S. market for GET signature set-ups or your own custom strategies in less than 10 seconds

- Results based on up-to-the-minute data

- Time frames ranging from 15 minutes to weekly

- Pre-built and user-built trading strategies

- a wide selection of parameters for trimming the list of stocks to just what you want

Sort By

Under the sort by field in the top left corner you'll find several scan types. A few of the popular scan types include:

Volume: Highest volume traded that day

Dollar Volume: Highest dollar volume (volume x share price) that day

Heavy Volume: Largest volume compared to their average volume

% Gainers: Highest % appreciation that day

% Losers: Greatest % depreciation that day

$ Gainers: Highest dollar appreciation that day

$ Losers: Highest dollar depreciation that day

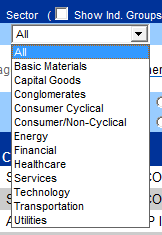

Sector

The Sector field allows you to view stocks belonging to certain Sectors or Industry groups.

Portfolio and Exchange

Under portfolio, you'll have three options to choose from. Stocks, Optionable, and Indices. Optionable allows you to filter stocks that also have equity options available. Under the exchange field you can select NYSE, AMEX, NASD or all us to include all 3 exchanges.

Intervals

there are several intervals to choose from depending on your trading strategy. the intervals include:

Weekly and Daily (long term and position traders)

Hourly (swing traders)

15 and 30 min (short term and day traders)

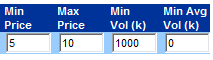

Min/Max price - Allows you to set price brackets (ie., minimum/maximum dollar value per share) to focus on stocks best suited to your trading needs.

Min/Avg Volume - The min volume is used to select stocks whose premarket trade volume exceeds the specified value. for example: if min volume is set to 100k, this means a stock has to trade over 100,000 shares since the market closed on the previous day to be included in the scan.

The Avg Volume is used to select stocks whose last 20 day average volume exceeds the specified value. For example: If Avg volume is set to 2000k, this means a stock has to trade over 2,000,000 shares average per day over the last 20 days to be included in the scan. Helpful for weeding out very thinly traded stocks whose movements are not supported by sufficient volume for trading.

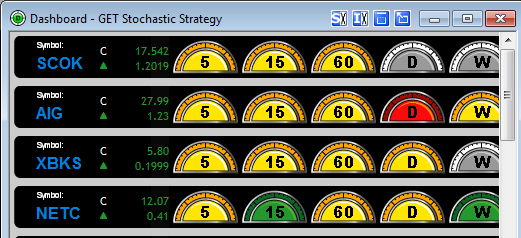

Export to Dashboard

Once you have performed a scan, you can quickly export the results directly into a dashboard window by clicking the 'export to dash' window. The scan results will populate in the new dashboard window that is launched.

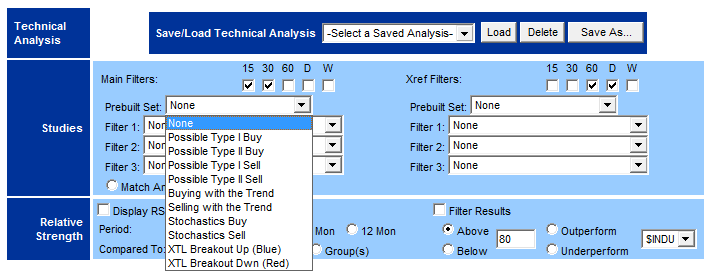

Pre-built Strategies

Under the studies section you'll find several time frames to choose from.

In this section you'll also find a drop down menu for prebuilt strategies. As shown in the image below there are many built in Advanced GET strategies to choose from including possible Type 1 buy/sell, XTL breakout up/down and more.

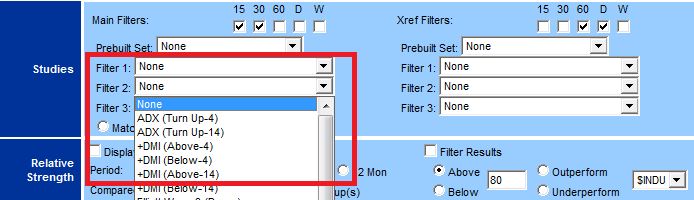

User-built Strategies

In addition to the default strategies, you can also create custom scans using up to 3 study filters. The user can combine standard studies and indicators to create custom trading strategies, including, ADX, Elliott Wave, MACD, Stochastics, Moving Averages, Oscillator pullback, Regression Trend and the Advanced GET set-ups, such as Type 1 and 2. Click the help button for a description of the various studies and indicators.

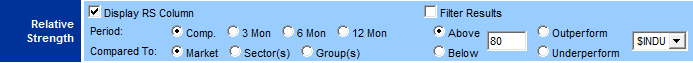

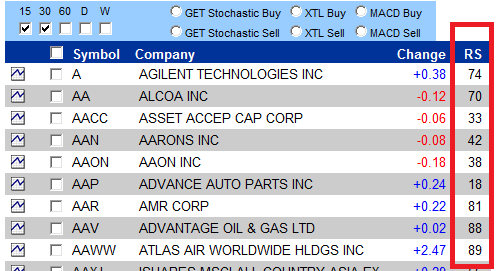

Relative Strength

The Advanced GET scanner is capable of calculating relative strength by comparing the stock to the entire market or just the stock’s sector or industry group for strong stocks or weak ones or for those out-performing or under-performing the Dow jones or Nasdaq indices. you can then rank stocks based on the results of the relative strength scan.

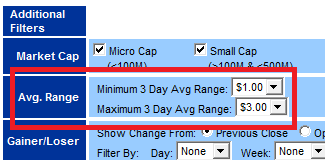

Range Selection

The user can choose the minimum and maximum price range of the stock based on the last three days. This is very important to day and options traders. For day traders, stocks with a larger daily range provide the potential for tradable swings during the day. Some options strategies look for stocks to expire within a small range while others require larger ranges. Range selection accommodates the various options strategies. Range selection accommodates the various options strategies.