Special Trade Conditions and Symbol Flags

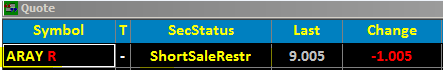

The following special conditions will appear as text next to a symbol in any window that displays quote information (detail, quote, summary, etc.) whenever these conditions occur:

The following special conditions will appear as text next to a symbol in any window that displays quote information (detail, quote, summary, etc.) whenever these conditions occur:

Text Flag |

Description |

R |

Special short sale restrictions. More on Restricted symbols below. |

H |

Trading has been halted on this issue |

X |

Symbol has gone X-Dividend |

F |

Fast Market Indicator (For selected Futures markets) More on Fast Market issues |

what does the "r" next to nasdaq symbols represent? in esignal version 10.6, the red "r" indicates that there is a "short sale restriction" in place for the stock. currently the red "r" designation is only displayed for nasdaq listed issues. short sale restrictions apply to nyse, amex, and arcx symbols as well. to view the restricted short sale designation for these issues esignal 10.6, you can add the security status field (right click an existing field, click add field then security status).

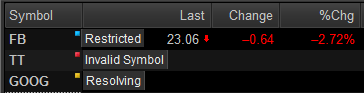

in esignal 11, a new mouse-over system has been implemented eliminating the need to add a separate column for security status updates. simply hover your mouse over the colored box next to the symbol to determine the corresponding status. for restricted symbols you'll see 'restricted' when mousing over the blue box (ticker: fb in the example below)

a blue square next to a symbol can mean the following:

- Bankrupt

- Trade Halted

- Bankrupt, Deficient, Deliquent

- Restricted

A Red Square next to a symbol can mean the following:

- No Data

- Timeout Elapsed

- Invalid Symbol

- Not Entitled (not subscribed)

a yellow square next to a symbol will mean: symbol resolving

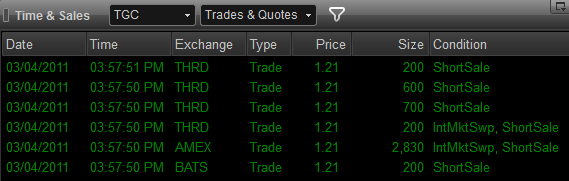

why does my time and sales show shortsale under the condition field? this is normal per exchange rules regarding regulation sho that are now being enforced. it simply means that the security currently has a short sale restriction (see below for additional details).

what is regulation sho? regulation sho provides a regulatory framework governing short selling of securities. regulation sho is designed, in part, to fulfill several objectives, including (1) establish uniform locate and delivery requirements in order to address problems associated with failures to deliver, including potentially abusive "naked" short selling (i.e., selling short without having borrowed the securities to make delivery); (2) create uniform marking requirements for sales of all equity securities; and (3) establish a procedure to temporarily suspend commission and sro short sale price tests in order to evaluate the overall effectiveness and necessity of such restrictions.

what securities qualify for this short sale restriction? there are 2 methods for determining what symbols qualify for this short sale restriction.

method 1 is an amendment (rule 201 - aka the alternative uptick rule) that introduces a circuit breaker rule that goes into effect when the trading center declares that a stock has decreased 10% or more from the prior day’s closing price.

method 2 is defined in rule 203(c)(6) of regulation sho - a "threshold security" is any equity security of any issuer that is registered under section 12 of the exchange act or that is required to file reports under section 15(d) of the exchange act (commonly referred to as reporting securities), where, for five consecutive settlement days:

why does my time and sales show shortsale under the condition field? this is normal per exchange rules regarding regulation sho that are now being enforced. it simply means that the security currently has a short sale restriction (see below for additional details).

what is regulation sho? regulation sho provides a regulatory framework governing short selling of securities. regulation sho is designed, in part, to fulfill several objectives, including (1) establish uniform locate and delivery requirements in order to address problems associated with failures to deliver, including potentially abusive "naked" short selling (i.e., selling short without having borrowed the securities to make delivery); (2) create uniform marking requirements for sales of all equity securities; and (3) establish a procedure to temporarily suspend commission and sro short sale price tests in order to evaluate the overall effectiveness and necessity of such restrictions.

what securities qualify for this short sale restriction? there are 2 methods for determining what symbols qualify for this short sale restriction.

method 1 is an amendment (rule 201 - aka the alternative uptick rule) that introduces a circuit breaker rule that goes into effect when the trading center declares that a stock has decreased 10% or more from the prior day’s closing price.

method 2 is defined in rule 203(c)(6) of regulation sho - a "threshold security" is any equity security of any issuer that is registered under section 12 of the exchange act or that is required to file reports under section 15(d) of the exchange act (commonly referred to as reporting securities), where, for five consecutive settlement days:

A security ceases to be a threshold security if it does not exceed the specified level of fails for five consecutive settlement days.

for detailed information, please visit the sec's website at:

(source: www.nasdaqtrader.com)

how long will the "r" stay on the quote window?

the exchanges in cooperation with the national securities clearing corporation, publishes a daily list of restricted securities:

nasdaq

amex

nyse

red "f" indicator for futures

the red "f" is a fast market indicator. a "fast market" is one in which, market conditions in the futures pit are disorderly to the extent that floor brokers are not held responsible for the execution of orders. in other words, this is a trading market in which the speed with which a security's shares are traded is so rapid that the most recent quote may be outdated before it can be reported. this is a temporary occurrence and usually lasts for only a brief period of time.

esignal - red "h" next to symbol

a red 'h' next to a symbol means there has been a trading halt.

a temporary suspension in the trading of a particular security on one or more exchanges, usually in anticipation of a news announcement or to correct an order imbalance. a trading halt may also be imposed for purely regulatory reasons. during a trading halt, open orders may be canceled and options may be exercised.

a trading halt gives all investors equal opportunity to evaluate news and make buy, sell or hold decisions on that basis. the stock exchange can also halt a stock at any time if it suspects unusual activity related to a stock's price. the stock will typically resume trading after 30 minutes, once news from the issuing company has been disseminated.

financial status indicators

financial status indicators are displayed when an issuer has failed to submit its regulatory filings on a timely basis, has failed to meet nasdaq's continuing listing standards, and/or has filed for bankruptcy. in esignal the values are designated by a yellow letter following the symbol (in the quote, summary, and portfolio windows).

other financial status indicators include:

d = deficient: issuer failed to meet nasdaq continued listing requirements

e = delinquent: issuer missed regulatory filing deadline

q = bankrupt: issuer has filed for bankruptcy

g = deficient and bankrupt

h = deficient and delinquent

j = delinquent and bankrupt

k = deficient, delinquent, and bankrupt

delayed data

the letter 'd' is also used to signify delayed data which is available as part of our delayed service bundles. the 'd' for delayed data should also match the same color as the symbol (white in the example below). those subscribed to delayed data should not confuse this designation for the financial status indicator which is yellow.

5th character nasdaq symbol

the special trade conditions and financial status indicators should not be confused with the nasdaq 5th character designation which uses a 5th character as part of the symbol:

FOR MORE INFORMATION PLEASE VISIT NASDAQ.COM | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||