This article provides instructions on integrating FXCM with eSignal using the FXCM plug-in.

Set-up requirements include:

1. An active subscription to eSignal.

2. The latest version of eSignal. Click here to download and install eSignal.

3. An open and funded account with FXCM.

4. Install the appropriate FXCM plug-in for the version of eSignal you're using.

Please follow the configuration instructons below to complete the set-up

Configure the FXCM Connection

Click Trade and select Broker Manager.

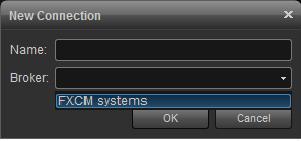

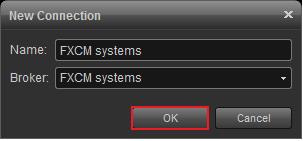

Click the Add Icon (+ sign).

Select FXCM from the Broker dropdown list.

Click OK to add FXCM to the Broker List.

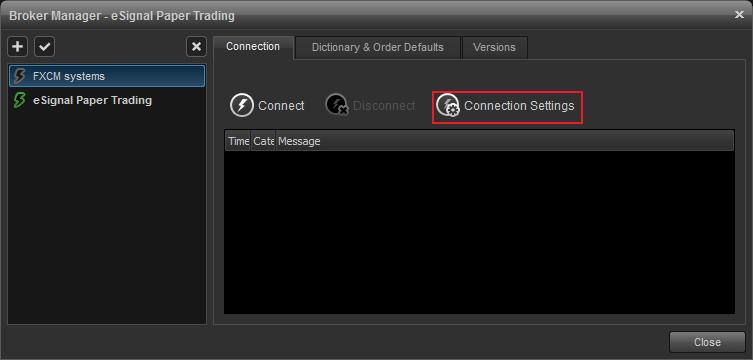

FXCM should now appear in the broker list on left. Click the Connection Tab, then click the Connection Settings.

The Connection Setting dialog has four fields.

Mode - Demo or Real, selet the Mode for your account type

Login- Your FXCM username

Password- User FXCM passoword

Open Trade Only NFA Compliance Rule Checkbox

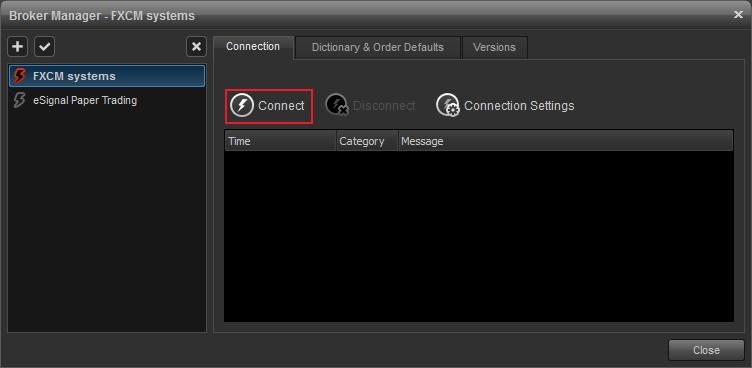

Once the configuration is complete click Connect.

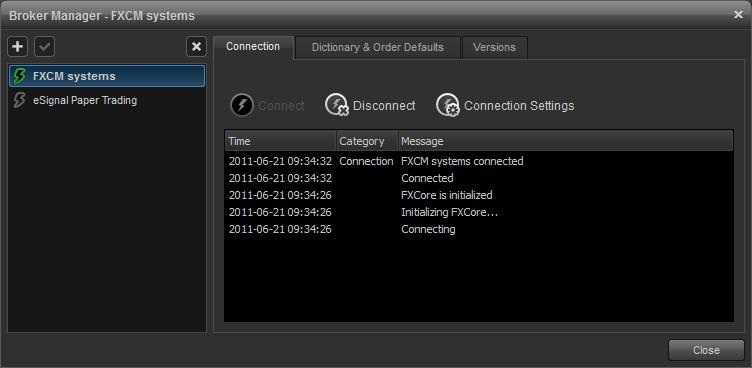

Once the FXCM plug-in establishes a connection, the icon will turn green and the message

tab will also show connected.

Symbol Mapping

To solve the symbol differences between eSignal and FXCM the symbol dictionary was implemented. The symbol dictionary will automatically associate a major number of the eSignal symbols with those used by FXCM. However there will be times when an eSignal symbol will need to be manually mapped to FXCM. To manually map symbols do the following.

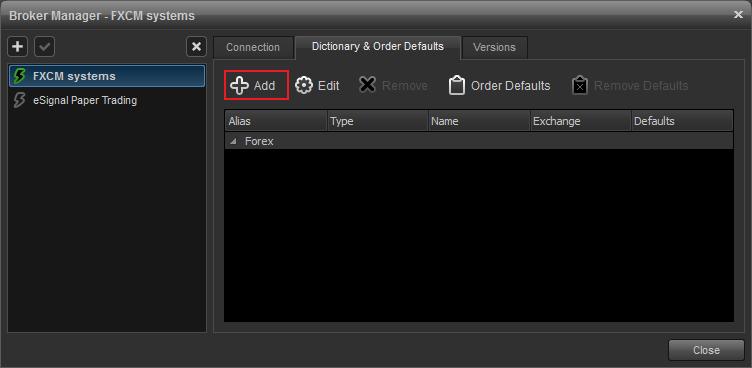

On the Dictionary & Order Defaults Tab in the Broker Manager Window Click Add.

Enter the eSignal symbol you would like mapped (AUD A0-FX) and click Lookup.

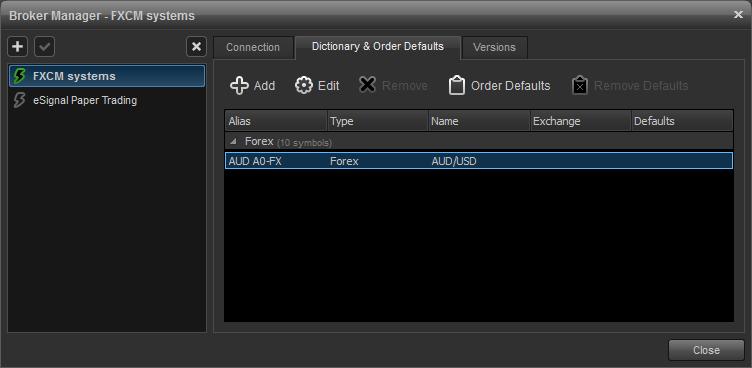

From the dropdown list of currency pairs select the one you want to map to eSignal. Once highlighted click OK

Click Accept on the Create Symbol Window.

The new symbol has now been added to your Symbol Dictionary, click Close.

Order Defaults

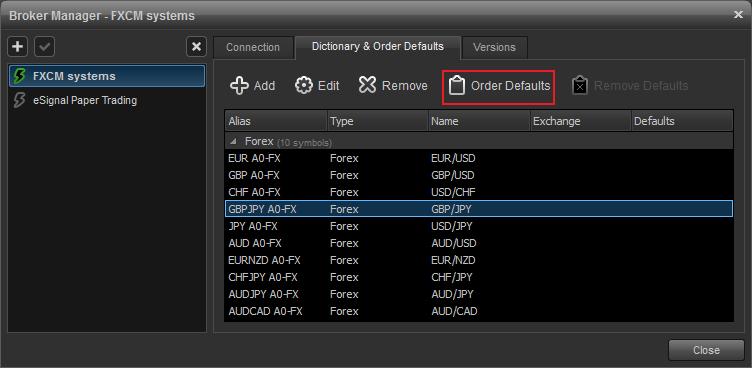

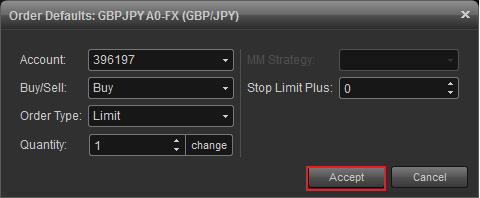

Pre-set order defaults allows users to assign things like quantity, and the type of order (ie market, limit or stop) in advanced. Users can set defaults for an asset class such as Stocks, Currencies and Futures or even a currency pair (GBPJPY A0-FX).

To set the Order Default, select the Dictionary & Order Defaults Tab on the Broker Manager Window (Trade, Broker Manager, Dictionary & Order Defaults) Highlight either the Asset Class or an Individual Symbol (GBPJPY A0-FX is used for this example). Click Order Default.

Set the order default using the option available from the dropdown menus. Now when this currency pair is traded, the Quantity and Order Type will be preset in the order ticket.

Removing Order Defaults

To remove order defaults, select the Asset Class or individual Symbol that has the order default set and click Remove Defaults.

Order Confirmation

The Order Ticket is considered the confirmation before a order is executed. If you would like to disable the confirmation prompt, click Trade, Trade Settings

Remove the check from the box for Confirm Order Before Submitting.

Hedging Rules for U.S. Forex Traders - NFA Compliance Rule 2-43(b)

The NFA compliance rule 2-43(b) requires that all orders must be executed First In First Out (FIFO). That is to say that when you have multiple positions in the same currency pair, the position which was first opened will be the first to be closed. NFA compliance rule 2-43(b) also prohibits hedging. Therefore, clients can no longer hold buy and sell positions on the same currency pair at one time. Because hedging is disabled traders can now offset existing positions by placing market orders. For example, to close a 10K EURUSD buy position, you would simply place a 10K EURUSD sell order.

FAQ

Q - What does this mean Forex Trading in the United States?

A - Basically, what this means if you attempt to go long and short on the same pair at the same time you will end up with no position – your broker will offset them against each other and you’ll have no trade left open. For those who trade with brokers like Gain, there is no change at all as that’s always been the case. Traders with other brokers who have allowed “hedging” will see that change shortly.