eSignal 12 - Integrated Trading Overview

This article provides an overview of the Integrated Trading components and features. eSignal offers Integrated trading for both our Broker Partners as well as our Trading Service Provider Partners.

Integrated Broker Partners

Execute trades from within the program with select online brokers whose applications are integrated with eSignal.

integrated trading service provider partners

our trading service provider partners offer a trading system whose ticket technology is integrated with esignal. execute trades from within esignal using the integrated trading service provider's plug-in. visit our trading integration partners for a list of approved partners and instructions to setup integrated trading.

the broker manager is a central hub for all broker plug-ins as well as esignal's paper trading. information on creating a new connections, the symbol dictionary, and order defaults can be found in kb article 4862.

order defaults

the order defaults settings can be customized so that all new orders will follow the same template. order size, order type and even a money management strategy can be set in advance to better expidite order execution. order default settings can be found in the broker manager under dictionary and order defaults. order defaults can be set as high as the category (stock, future or currency) so that any instrument in the category will use this specific template. they can also be set on an individual instrument of a specific category.

setting a default trading partner

esignal 12 allows user to connect to multiple brokers and set a default broker for each of the instrument type and at that same time. to set the default broker click on the blue es (top left corner of esignal program), then click on applications properties. in the application properties window select "trading default connection" on the left. under trade default connection select the instrument type and using the dropdown menu select a broker. repeat the proces for each of the instruments type you'll be trading.

once you've established your connections with the brokers, you're ready to begin trading with esignal. if your buy and sell buttons are greyed out, it is most likely you are not connected to the selected broker for that instrument type. click here to setup esignal paper trading as your default broker. a green lightning bolt will display when the broker is connected.

placing trades

there are three ways you can place a trade and execute your orders within the program. first, you can enter trades directly from the esignal chart and trade manager with a single mouse click. additionally, you can single click from a pre-configured button on the custom toolbars and trading panels. point and click trading from any window that has the bid/ask or last price.

the trade manager window visualizes the trading process so orders can be sent to the broker with a single click. the main part of the trade manager window is the dome (depth of market) grid. it displays bid, ask and price with their volume as well as the trading range. orders can be sent straight from this window. to open a trade manager window, select trade manager from the new menu at the top of esignal or click trade manager from the trade menu.

depth of market columns

Price - Displays the possible price values in ascending order. Every row corresponds to the Minimum Price Movement value for the current symbol. The High and Low prices for the current day are indicated by highlighting the corresponding cell. The Last Traded price is highlighted in a Gold Color by default

Bid- Displays the Bid Size values for the current price level as a horizonal histogram and in figures (to visualize liquidity levels). You can set a Buy order by clicking the disired cell in the Bid columns.

trading control

buy and sell button: selecting either button will enter the appropriate order type for that button.

trading from the charts

trading from the charts is one of the primary trading functions in esignal. on the chart toolbar click the trading icon to reveal the trading panel (buy and sell buttons). the trading panel is preconfigured with buttons for immediate order entry. the available buttons include buy or sell at market, buy or sell at ask, and buy or sell at bid. if these buttons are greyed out or disabled you'll need to set a default broker.

another way to trade through the charts is to right click the chart and select new order from the menu. on the new order menu you have a selection of order types you can select. these options will be dependent on where you right click the chart. when you right click on the chart above the last trade (and select new order) the choices will include buy stop, sell limit, and sell stop limit. right clicking below the last trade price will include buy limit, sells stop, sell stop limit to place your order. a custom toolbar can also be equipped with trade button features for quick order execution.

once the broker accepts the order it will display on the chart as a working order until the order is filled. you can also adjust the order by dragging it up or down to create a new order at a different price point. while the order is still active, you can cancel it by clicking the x just to the right of the order or by right clicking on the order and selecting cancel from the menu.

Point and Click Trading

Double-clicking on either the Last, Bid, or Ask price in any window that has the fields will result in an order. For an example follow these steps in your eSignal applicatons

2. Enter a symbol (eg. GM)

3. Double-click on either the Last, Bid, or Ask price in the Watchlist. The result is an Order Ticket.

4. The Order Ticket pulls information from the quote window, like price and stock symbol; and information

from preferences, such as order-type, time in force, etc..

a. Double-clicking the Bid. When you double-click the bid, the order type will be Sell, and the limit

price will be the bid price (hold down the CTRL key from your keyboard when double-clicking, and the

order type will be a Buy).

b. Double-clicking the Ask. When you double-click the ask, the order type will be Buy, and the limit

price will be the ask price (hold down the CTRL key from your keyboard when double-clicking, and

the order type will be a Sell).

Viewing Executed Trades

Your trades or transactions can be viewed in the Account Manager (available on the eSignal Menu under Trade). This window houses all of your transctions (i.e. pending orders, executions and portfolio).

account manager

the account manager window allow you to monitor your orders, positions, executions, account balances and messages. from within the account manager you can modify, cancel, reverse or execute new order depending on the tab you're viewing. it is possible to view the status of your trades and order by clicking on the corresponding tab for order, positions, and executions. trades displayed in the account manager will be trading in real-time.

Order and Execution Tabs

The Order tab displays all orders (filled, cancelled and working) placed during the trading session. If eSignal is restarted a new session wil be created. Unfilled orders can be cancelled or modified via the right click menu of the Order tab. Right click and select Close All if you wish to close all open position and cancel any working orders. Execution Tab: The Execution tab displays all buy and sell order executed during the trading session.

Positions Tab

The position tab displays any position held during that trading session It also so shows the number of shares, average price for shares purchased, unrealized profit and loss for each of the positions, and number of tick in or out of the money.

Account Tab

The Account Tab displays all the information regarding your account, buying power, profit and loss for the trading day.

Message Tab

The Message Tab is a complete log of any and all comminications between eSignal and the Broker. This include all trades (placed, executed, cancelled or modified), connection status, and any error message that may have occured.

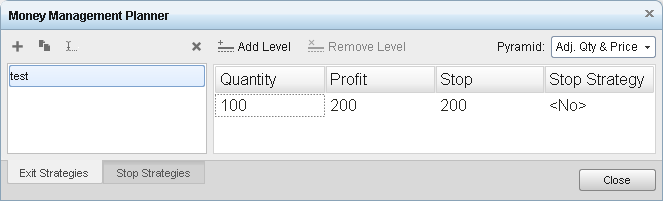

the money manager in combination with the trade manager and chart trading, allows traders to use predefined, sophisticated and intelligent order management for profit taking and loss mitigation after an entry has been established. the money manager is used to set up various stop and profit orders to automatically come into play once the entry order is filled. these stop and profit strategies can be setup to change from fixed stops to trailing stops multiple times and on multiple levels as long as the position is still active.

order ticket

the order ticket will appear if you selected new order from the trade menu, clicked one of the trade buttons, or selected one of the trade options from the right click menu on the chart. the order ticket can also be consider as the order confirmation window which allows verifcation of order before they are submitted. in the order ticket you can also see additional details for your orders, set a money management strategy or make changes to the existing orders.

confirmations

the order ticket is also used as a confirmation before a trade is executed. to disable this prompt, please click "application properties" => "trade " => and remove the checkmark from "confirm order before submitting"

sound schemes/notifications

sound schemes enable you to play sounds and receive pop up messages when certain events happen with your executed trades on broker connections. sound schemes can be enabled or disabled in the application properties and notification. add or remove the checkmarks from the boxes and select different sound files to play for specific events in the window.