esignal - options help

how do i find all the options available on a given stock or index?

if you start with the root, say qqqq, then right-click on the symbol in a quote window then choose option chain, you will see all the options listed.

note: you will need to be subscribed to opra options in order to view the option chain

how to link individual options from an option chain to another window:

you can use the button towards the top right corner of option chain's title bar

towards the top right corner of option chain's title bar  .

.

the is a secondary linking button which allows you to link the interior of the window to other windows when using options. for instance, if you click on an option in the options window, you will send that option to any window which has the same color as the secondary link. this is helpful in sending a particular option to the market depth window for regional options or to a historical advanced chart to see daily options.

is a secondary linking button which allows you to link the interior of the window to other windows when using options. for instance, if you click on an option in the options window, you will send that option to any window which has the same color as the secondary link. this is helpful in sending a particular option to the market depth window for regional options or to a historical advanced chart to see daily options.

viewing options in a chart

historical data for stock options can be viewed in a daily chart with the regular subscription to opra. to be able to view historical options data in an intraday chart, a second subscription is required, intraday option history ($50.00/month).

are nse options available? we carry nse stock options (nse futures options are not available). once you are subscribed to the nse and the nse options, you can locate the symbols using an option chain window. enter the root symbol (i.e. $nifty-nse, ster.eq-nse) into the option chain window. once you have the individual symbols you can enter them (i.e. o:nifty 11k4200.00-nso) directly into a chart or quote window.

do you have "flex" options?

unfortunately, we do not. these are options where the contract specifications (expiration, strike) are negotiated by the buyer and seller when the initial trade is made.

how often does open interest update?

this updates once a day after the market closes. therefore the next trading day you are seeing the open interest for the previous trading day.

how do i find all the options available on a given stock or index?

if you start with the root, say qqqq, then right-click on the symbol in a quote window then choose option chain, you will see all the options listed.

note: you will need to be subscribed to opra options in order to view the option chain

how to link individual options from an option chain to another window:

you can use the button

towards the top right corner of option chain's title bar

towards the top right corner of option chain's title bar  .

. the

is a secondary linking button which allows you to link the interior of the window to other windows when using options. for instance, if you click on an option in the options window, you will send that option to any window which has the same color as the secondary link. this is helpful in sending a particular option to the market depth window for regional options or to a historical advanced chart to see daily options.

is a secondary linking button which allows you to link the interior of the window to other windows when using options. for instance, if you click on an option in the options window, you will send that option to any window which has the same color as the secondary link. this is helpful in sending a particular option to the market depth window for regional options or to a historical advanced chart to see daily options.viewing options in a chart

historical data for stock options can be viewed in a daily chart with the regular subscription to opra. to be able to view historical options data in an intraday chart, a second subscription is required, intraday option history ($50.00/month).

are nse options available? we carry nse stock options (nse futures options are not available). once you are subscribed to the nse and the nse options, you can locate the symbols using an option chain window. enter the root symbol (i.e. $nifty-nse, ster.eq-nse) into the option chain window. once you have the individual symbols you can enter them (i.e. o:nifty 11k4200.00-nso) directly into a chart or quote window.

do you have "flex" options?

unfortunately, we do not. these are options where the contract specifications (expiration, strike) are negotiated by the buyer and seller when the initial trade is made.

how often does open interest update?

this updates once a day after the market closes. therefore the next trading day you are seeing the open interest for the previous trading day.

Can I chart expired options? Yes, expired options such as O:BAC 12F11.00 are available on Daily intervals or higher (Weekly, Monthly, etc.).

How do I find the root symbol for a modified option?

You can find the underlying stock or index by adding the "Underlying Symbol" field to a Quote, or Summary window (click here for help) or Detail Window (click here for help), and then adding the option to that window.

Why do you do downgrade options to zero volume status?

When an optionable stock or index starts to move, the Options exchanges will run a routine called auto-quoting that basically updates the current bid and ask of all the underlying options. While valid quotes, they don't represent true buyers and sellers. As a result, tens of thousands of options get auto-quoted everyday. The amount of bandwidth needed to transmit every one of these quotes is enormous. Since the vast majority of these updates are not representing true buyers and sellers, we elect to bunch these updates together and only send periodically during the day. Once any individual option starts to trade, it then gets upgraded to real-time status.

Why aren't all my stock or index options' bid or ask quotes matching my broker?

If that's the case, you are most likely tracking what we term zero volume options. These are options that did NOT trade the previous day. As a result, we only update the bid and ask on each of these options every hour or so during the day, sometimes even less often if the markets are busy. Once that option trades, it gets upgraded immediately so all bid, ask and trade information is then sent in real-time. If it doesn't trade for an entire day again, it's downgraded back to zero volume option status and the same pattern is repeated for all options, each day.

Why is the Bid & Ask data for my options blank?

The exchange that sends us the options data sends zeros when there is no new Bid & Ask information. eSignal used to show the previous Bid & Ask information until new information was received. This resulted in old data. Now, the Bid & Ask will remain blank until new data is received.

Why are the Bid and/or Ask on my option very far from the last price?

We post only bid and ask quotes from the exchange. They are derived from actual customer orders, rather than theoretical "auto-quotes" as in the world of stock options. So if the market is thin in any particular contract (and most are thin), the bid/ask spread could be very wide and far away from where the market might be.

Normally we clear out the bid/ask at the end of each day, but that is triggered by the settlement coming from the exchange. Sometimes settlements are not sent for isolated contacts, so there will be days where a bid/ask gets carried over from the previous day. Any new bid/ask will overwrite such an old quote, but the old one could linger for a while, depending on how actively quoted the contract is.

Keep in mind that other quote systems, or their desktop applications may calculate a theoretical bid/ask. Merely because their spreads are smaller, seem more reasonable, or have a more recent timestamp, does not mean that eSignal is missing updates. The timestamp on another system may even be the last time they calculated a theoretical bid/ask.

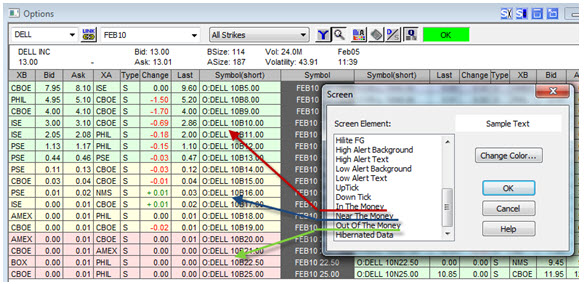

Option Chain Filter - The option filter for in/near/out of the money strikes was added in version 10.0. This allows users to set different background colors for strikes based on the underlying equity's current last price. To apply these colors, click on the Option Chain menu at the top of the screen then click on Colors to bring up the screen seen below:

all calls below the current price and all puts above the current price will be colored with the color chosen for in the money. the following 6 strikes on the other side of the current price will be colored with the color for near the money. the default number of strikes is 6, but you can change that to another number by clicking on the option chain menu at the top of the screen then clicking on filters. the setting is at the bottom of the filters screen. the remaining strikes will be colored with color for out of the money.

in order to change the color of any part of the option chain window, click the option chain menu at the top of the esignal screen then click on colors (you will see the above screen). click the screen element you want to change then click the change color button to bring up the color palette. you will see a grid of colors that you can select.

note: upgrading from an older version of esignal may result in having the in/near/out of the money colors default to black. the colors can be adjusted by following the preceding instructions.