Overview

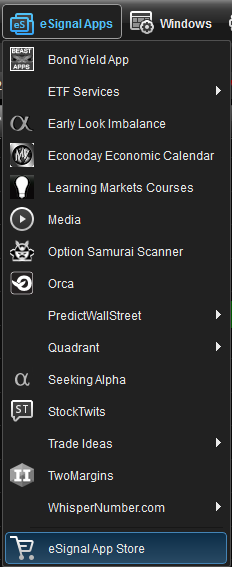

Now in eSignal…the Commitments of Traders Reports… so you can follow the smartest money in the market. The Commercials, the users and producers of commodities, these are the most informed players in the game! The markets were set up for them, not traders, yet thanks to this powerful information we can do what they do.

Proven for 40 years by traders around the world, this is the report real traders really use to find the best trades before they take off. The COT report has been described as a trend-followers answer to retracement entries and gaining insight into which trends may be sustainable. This means you can know, each week, what the Commercials, hedgers and commercial interests, have been doing; actually see their buying as well as selling. You will also be able to find out what the fund managers, Large Speculators, have been doing for their own accounts, Finally, you’ll be able to see what the Small Speculators, the public, have been doing

To Subscribe to the Indicators

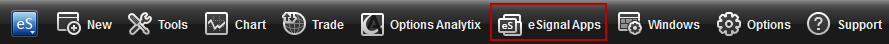

To add this service to your account, click eSignal Apps icon from the eSignal 12 main menu (requires eSignal 12.2 or newer):

Locate Larry Williams COT Indicator Package and click Add Now (indicated subscription fee will apply):

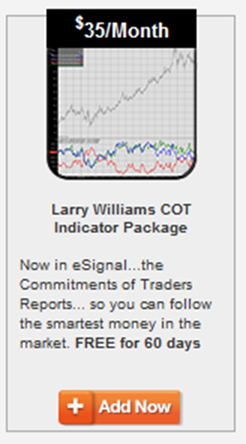

Applying the Indicator to a Chart

Description of the Indicators

• LNLCOTCCommercialsIndex - Is a proprietary index to determine when the Commercials (hedgers) are significantly long or short a market based on the data released by the CFTC each week.

• LNLCOTCCommercialsNetPositions – The Commercials (hedgers) net positions.

• LNLCOTCLargeSpecIndex - While most people focus only on the Commercials, I have found it is very helpful to know what the Large Speculators are doing in the marketplace.

• LNLCOTCLarge SpecNetPositions – The Large Speculators net positions.

• LNLCOTCSmallSpecIndex - This is a measure of public sentiment, as it represents small traders as defined by the CFTC. I use this index to get a sense of what the public trader is doing and look for times when the CFTC report shows they have more longs than short or vice versa.

• LNLCOTCSmall SpecNetPositions – The Small Speculators net positions.

For Further Assistance