Advanced GET Scanner Help

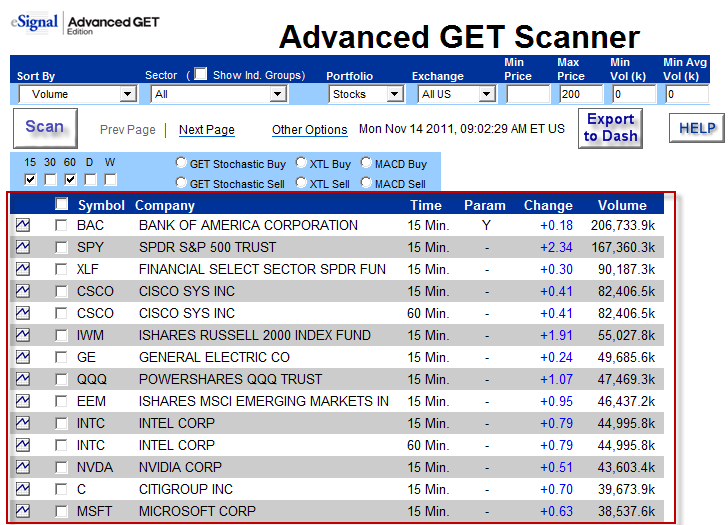

The Advanced GET Scanner can automatically apply technical indicators and fundamental criteria across the entire market to find possible trading situations. It allows you to control your results by displaying information that is critical to you. These displays include company name, price change or percent change, daily or year high and low, volume or average volume, bid/ask spread, and market capitalization. You can also access charts, news, and company research directly from your scan page.

Click here for more information on how to use the Advanced GET Scanner.

For more information on Advanced GET Strategies, check out these links:

Introduction to Elliott Theory 101

Practical Applications of a Mechanical Trading System

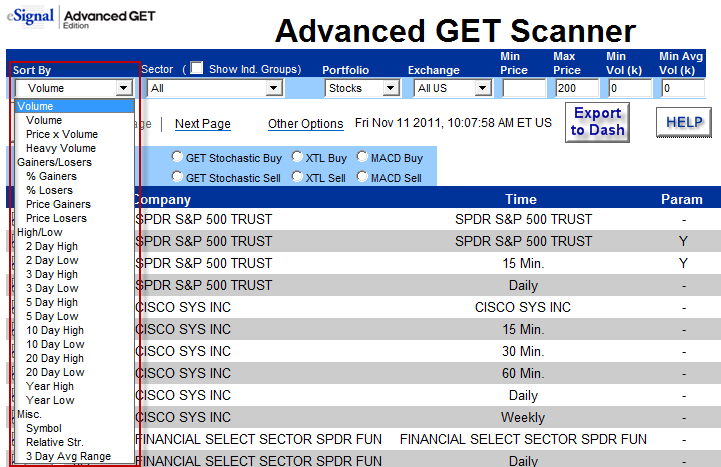

sort by

the first section of the scanner is the sort by selection box. this sorts the scan results lists by the parameter selected.

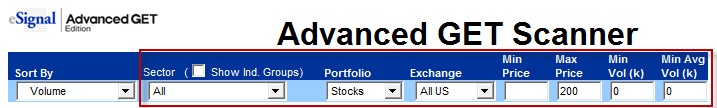

filters

allows to limit your search

Sector - Allows you to view stocks belonging to certain sectors or industry groups only. Sector filters are not applied when scanning Indices.

Show Ind. Groups - Toggles the displays of the industry groups listing.

Portfolio - Allows you to limit your search to a specific group of issues such as Stocks (searches all US stocks), Optionables (searches only stocks that have options), and Indices (searches only indices). For Indices, certain filters are not applied, such as those relating to volume and market capitalization.

Min/Avg Volume

The Min Volume is used to select stocks whose daily traded volume exceeds the specified value. For example, if Min Volume is set to 100k, this means a stock has to trade over 100,000 shares in the current trading session to be included in the scan.

The Avg Volume is used to select stocks whose last 20 day average volume exceeds the specified value. For example: If Avg Volume is set to 2000k, this means a stock has to trade over 2,000,000 shares average per day over the last 20 days to be included in the scan. Helpful for weeding out very thinly traded stocks whose movements are not supported by sufficient volume for trading.

These filters are not applied when scanning Indices.

Min/Max Price

Allows you to set price brackets (i.e., minimum/maximum dollar value per share) to focus on stocks best suited to your trading needs.

these filters are not applied when scanning indices.

misc settings

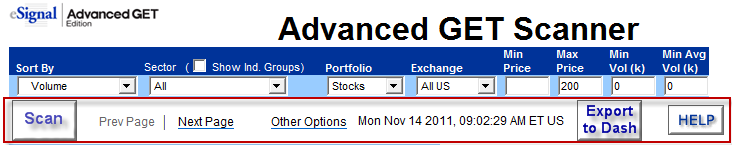

scan

after selecting scan parameters, click the scan button to start the scan.

prev/next page

allows you to display the next set of issues that meet your criteria.

other options

takes you to the table at the bottom of the page where you can select more options.

export to dash

select the symbols you want to export to a dashboard window. clicking this button will launch a dashboard window with the selected symbols displayed on it.

help

clicking the help button will display this page.

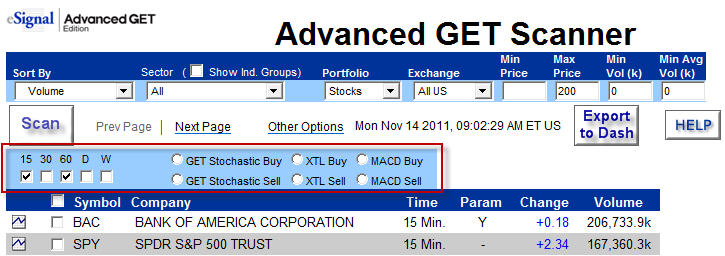

prebuilt scans

quick, convenient way to configure time frames and prebuilt scan without having to do it in the studies section below.

scan results

displays the results obtained by the scan parameters.

technical analysis

this section allows you to select scan the parameters based technical analysis studies.

save/load technical analysis

this feature allows you to save the parameters studies, and relative strength of your scan setup. this will not save any other fields.

to create a saved parameter: first create your scan, then click on save as..., a window at the top of the screen will appear, type the name of the parameters that you want to save. now click on ok. the screen will reload and the new parameter will be saved.

to load your saved parameters: click on the down arrow to the left of the load button, this will drop down a list of your saved parameters. select the parameters that you would like to load then click the load button. the page will refresh and the new parameters will be loaded.

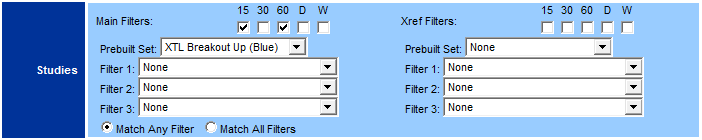

studies

main filters: allows you to select timeframes, prebuilt parameter sets and filters to apply to scans.

xref filters: allows you to select timeframes, prebuilt parameter sets and filters to apply an additional level of filters to scans set up with the main filters.

time frames/xref time frames

allows you to specify various time frames which can be searched. if a search parameter is true for any one of the selected time frames, the issue will appear in the list. 15, 30, 60 minute intraday time frames are available as well as daily, weekly and monthly time frames.

prebuilt parameter set, prebuilt xref parameter set

the prebuilt parameter set is used to initially scan the market for issues matching its underlying parameters based on advanced get trading strategies. if an prebuilt xref parameter set is also selected, then the results of the initial scan are further examined to see if they also match this second parameter set. the following parameter sets have been predefined:

possible type i buy

possible type ii buy

possible type i sell

possible type ii sell

buying with the trend

selling with the trend

stochastics buy

stochastics sell

xtl breakout up (blue)

xtl breakout dwn (red)

filter 1,2,3 : these parameters are used either to further refine the trading strategy defined by the main/prebuilt xref parameter set, or to create your own curtomized trading strategy. you can select from among the following parameters:

adx/dmi

adx (turn up-4)

adx (turn up-14)

+dmi (above-4)

+dmi (below-4)

+dmi (above-14)

+dmi (below-14)

elliott waves

elliott wave 3 down

elliott wave 3 up

elliott wave 4 down

elliott wave 4 up

elliott wave 5 down

elliott wave 5 up

MACD

MACD (Above)

MACD (Below)

MACD (Cross Above)

MACD (Cross Below)

Moving Average

Moving Average (Price Above 6/4)

Moving Average (Price Below 6/4 )

Moving Average (Price Cross Down 6/4 )

Moving Average (Price Cross Up 6/4)

Moving Average (Price Above 20)

Moving Average (Price Below 20)

Moving Average (Price Above 50)

Moving Average (Price Below 50)

Moving Average (Price Above 100)

Moving Average (Price Below 100)

Moving Average (Price Above 200)

Moving Average (Price Below 200)

Oscillator Pullback

Oscillator Pullback (Positive)

Oscillator Pullback (Negative)

PTI

PTI > 35

Regression Trend Channels

Reg. Trend Channel (Break Up)

Reg. Trend Channel (Break Down)

Stochastic

Stochastic Above 75

Stochastic Below 25

Stochastic NFB Above 75

Stochastic NFB Below 25

XTL

XTL (Breakout Bar)

XTL (Down-Red)

XTL (Up-Blue)

match any parameter in set/match all parameters in set

allows you to specify whether an issue must be positive for all the parameters in the prebuilt parameter set to be considered a match, or if it must only match one of its parameters. this setting does not affect the prebuilt xref parameter set matching – the system always considers all the parameters that make up the prebuilt xref parameter set.

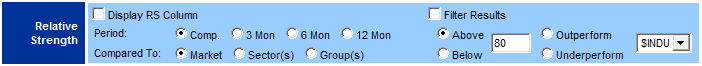

relative strength

the relative strength differs from the rsi. the relative strength is appropriately named because it provides a measurement of an issue's strength relative (as compared) to the market, a sector, or a group. a rs of 50 means that the issue is neutral or equal to the market, sector or group. above 50, means the issue is outperforming, and below 50, it is underperforming. strong rs values are associated with up trends, and weak rs values are associated with down trends.

These settings allow you to select, display, and filter by Relative Strength.

display relative strength: this allows you to display the selected relative strength information in the results table.

period: this allows you to select the period over which the relative strength is calculated, either 3 months, 6 months, 12 months, or a composite of all of these periods.

compared to: the allows the user to select the other issues that an issue is compared against: either just issues within the same group, the same sector, or against all other issues in the market.

filter results: this allows you to filter issues based on the selected relative strength.

above: only show those issues whose relative strength is greater than the given number.

below: only show those issues whose relative strength is less than the given number.

outperform: only show those issues whose relative strength is greater than that of the selected indices.

underperform: only show those issues whose relative strength is less than that of the selected indices.

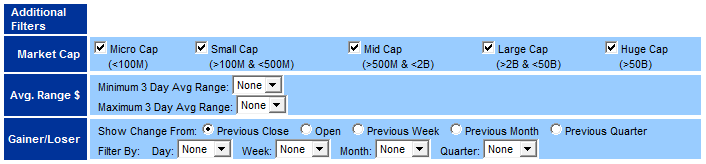

addtional filters

market cap

allows you to eliminate stocks whose market capitalization are outside the specified boundaries.

micro cap (<100m)

small cap (>100m & <500m)

mid cap (>500m & <2b)

large cap (>2b & <50b)

huge cap (>50b)

average range: allows you to specify a minium/maximum price range based on a 3 day average.

gainer/loser

show change from: calculates the change and % change either from the previous close, open, previous week, month and/or quarter.

filter by: allows you to filter by none, up or down according by day, week, month or quarterly.

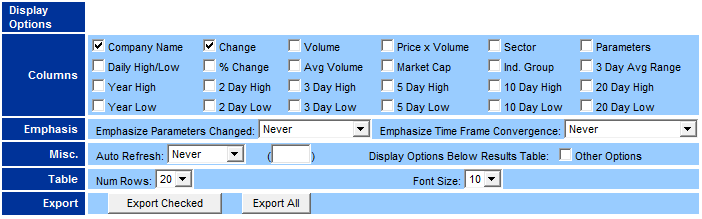

display options

columns

allows you to select additional information to be displayed for each issue which meets your criteria. additional criteria is listed below:

Company Name Change Volume

$ Volume Sector

Parameters Daily High/Low

% Change Avg Volume

Market Cap Ind. Group

Year High Year Low

2 Day High 2 Day Low

3 Day High 3 Day Low

5 Day High 5 Day Low

10 Day High 10 Day Low

20 Day High 20 Day Low

Emphasis

Emphasize Parameters Changed: Highlights parameters that have become positive within the selected amount of time. This can be utilized by choosing from Never, In Last 15 Minutes all the way up to 2 days ago.

Emphasize Time Frame Convergence : Highlights symbols whose parameters are positive in more than one time frame. This too can be utilized by choosing from Never, When all converge, and When some converge

Misc.

Auto Refresh: forces the database to be scanned again in the selected interval. Basically it is a countdown time, that will count down between 2 and 15 minute intervals. It will also display how much time is left to let you know how long is left until this occurs.

Show Change From: calculates the Change and % Change either from the Open price or the previous days closing price.

Display Options Below Results Table: Allows user to move options blocks at top of the page to the bottom of the page.

Table

# Rows: allows you to set the number of issues that are displayed at onet time, it can be from 10 to 50 rows.

Font Size: allows you to change the size of the text in the results table, it can be from 6 to 14.

Export

Allows the user to export the results of a scan to a local file. This file created in CSV format (Comma Separated Values). It is easily read by most spreadsheet programs, such as Excel.

Export Checked: Each row in the results table has a checkbox to the left of the symbol that the can be checked on or off. This option will only allow the symbols that are checked to be exported.

Export All: Exports the displayed information for all the displayed results.

Prebuilt Sets

Possible Type I Buy

This identifies issues that are Type I Buy setups, which occur after the Elliott Wave 4 retracement is completed and the uptrend is continued. Click here for a video explaining Type I and Type II trades.

(Elliott Wave 4 (Down)

Oscillatior Pullback Positive

PTI (>35)

Possible Type I Sell

This identifies issues that are Type I Sell setups, which occur after the Elliott Wave 4 retracement is completed and the downtrend is continued. Click here for a video explaining Type I and Type II trades.

Elliott Wave 4 (Up)

Oscillator Plullback Negative

PTI (>35)

Possible Type II Buy

This identifies issues that are Type II Buy setups, which means that the Elliott Wave 5 in a downtrend is over, and the trend will turn upward. Click here for a video explaining Type I and Type II trades.

Elliott Wave 5 (Down)

Moving Average (6/4 Above)

Possible Type II Sell

This identifies issues that are Type II Sell setups, which means that the Elliott Wave 5 in a uptrend is over, and the trend will turn downward. Click here for a video explaining Type I and Type II trades.

Elliott Wave 5 (Up)

Moving Average (6/4 Below)

Buying with the Trend

This identifies issues that are in a Stochastic oversold condition, where the current price action may be close to a bottom. The XTL (Up-Blue) indicates that the trend is beginning to move up. By combining these two parameters statistical odds are increased for a more successful "momentum" buy opportunity.

Stochastic (Below 25)

XTL (Up-Blue)

Selling with the Trend

This identifies issues that are in a Stochastic overbought condition, where the current price action may be close to a top. The XTL (Down-Red) indicates that the trend is beginning to move down. By combining these two parameters statistical odds are increased for a more successful "momentum" sell opportunity.

Stochastic NFB (Above 75)

XTL (Down-Red)

Stochastics Buy

This identifies issues that are in a Stochastic oversold condition, where the current price action may be close to a bottom. A price move holding above a 6/4 moving average may indicate the price is beginning to move upwards and improves the odds of success for a potential buy opportunity. Click here for a video on using Stochastic and trading with it.

Stochastic NFB (Below 25)

Moving Average (6/4 Above)

Stochastics Sell

This identifies issues that are in a Stochastic overbought condition, where the current price action may be close to a top. A price move holding below a 6/4 Moving Average may indicate the price is beginning to move downwards and improves the odds of success for a potential sell opportunity. Click here for a video on using Stochastic and trading with it.

Stochastic NFB (Above 75)

Moving Average (6/4 Below)

XTL Breakout Up (Blue)

This identifies issues that are just beginning to start an up trend. This can be used on its own, or as an Prebuilt/ Xref Parameter Set to confirm another trading strategy. Click here for a video on using XTL and trading with it.

XTL (Up-Blue)

XTL(Breakout Bar)

XTL Breakout Down (Red)

This identifies issues that are just beginning to start a down trend. This can be used on its own, or as an Prebuilt Xref Parameter Set to confirm another trading strategy. Click here for a video on using XTL and trading with it.

XTL (Down-Red)

XTL(Breakout Bar)

Filter 1,2,3 Studies

ADX/DMI

General Description

The ADX is a helpful trend indicator. The Average Directional Movement (ADX) is a momentum indicator developed by J. Welles Wilder. The ADX is designed to measure if a market is trending and to what extent. The Directional Movement Index (DMI) is another momentum indicator developed by Wilder. It is designed to determine whether a trending or non-trending pattern exists in a market.

This indicator measures-- regardless if the direction of price movement is in an up or down trend-- the strength of the trend. The higher the value, the stronger the trend. When the ADX is moving higher, the market is in a trend mode. The trend can be either up or down. The +DMI and -DMI identify which direction the trend is going. When the +DMI is above the -DMI the market is stronger. Conversely, if the -DMI is above the +DMI, the market is weaker. By identifying when the ADX turns up, in either situation (stronger or weaker), a potential beginning point of a trend can be identified. Subsequently, when the ADX keeps turning up, a continuation of a trend can be identified. A setting of 4 may be choppier but will identify more potential opportunities. A setting of 14 smoothes out the signals. Welles Wilder, the developer of the DMI, suggests what he calls the 'extreme point rule'. This rule states, "On the day the +DMI crosses above or below the -DMI, don't take the trade. Just take note of the high or the low of the day.

The ADX-DMI is actually three separate indicators.

1. The ADX indicates the trend of the market. This is typically used as an exit signal.

2. The +DMI measures the strength of upward pressure.

3. The -DMI measures the strength of downward pressure.

ADX Turn Up-4

This identifies issues where the ADX line has just made a turn up from its previous location. The period that the ADX is being calculated on is 4.

The ADX Period number indicates the number of bars to use in the calculation of the ADX

ADX Turn Up-14

This identifies issues where the ADX line has just made a turn up from its previous location. The period that the ADX is being calculated on is is 14.

The ADX Period number indicates the number of bars to use in the calculation of the ADX

+DMI(Above-4)

This identifies issues where the +DMI value is above the -DMI value. The period that the ADX is being calculated on is 4.

The ADX Period number indicates the number of bars to use in the calculation of the ADX

+DMI(Below-4)

This identifies issues where the +DMI value is below the -DMI value. The period that the ADX is being calculated on is 4.

The ADX Period number indicates the number of bars to use in the calculation of the ADX.

+DMI(Above-14)

This identifies issues where the +DMI value is above the -DMI value. The period that the ADX is being calculated on is 14.

The ADX Period number indicates the number of bars to use in the calculation of the ADX.

+DMI(Below-14)

This identifies issues where the +DMI value is below the -DMI value. The period that the ADX is being calculated on is 14.

The ADX Period number indicates the number of bars to use in the calculation of the ADX

Elliott Waves

The simplified version of Elliott Wave theory states that you will have a 5 wave sequence in either an up or down direction, followed by some kind of corrective pattern (most of the time), and then a new 5 wave sequence in the opposite direction.

The full Elliott Wave theory is much more complicated than this, but a good overview can be found at here. We recommend you read the overview to get a good basic understanding of Elliott Wave theory before utilizing these scans in your trading strategies.

The Elliott Wave scans are used to identify when issues are in one of the last 3 stages of the 5 wave sequence. The last 3 stages of an overall upward wave sequence are Wave 3 Up , Wave 4 Down, Wave 5 Up. The last 3 stages of an overall downward wave sequence are Wave 3 Down, Wave 4 Up, Wave 5 Down.

Elliott Wave 3 Up

This identifies issues that are currently labeled as Elliott Wave 3 in an overall upward wave direction. The primary usage of this scan is to identify the early stages of this sequence, either to take advantage of the strong upward momentum using "momentum" trading strategies, or to use this information to help prepare in advance for a good Type 1 Buy setup.

Elliott Wave 3 Down

This identifies issues that are currently labeled as Elliott Wave 3 in an overall downward wave direction. The primary usage of this scan is to identify the early stages of this sequence, either to take advantage of the strong downward momentum using "momentum" trading strategies, or to use this information to help prepare in advance for a good Type 2 Sell setup.

Elliott Wave 4 Up

This identifies issues that are currently labeled as Elliott Wave 4 in an overall downward wave direction. The primary usage of this scan is to identify Type 1 Sell opportunities that are setting up.

Elliott Wave 4 Down

This identifies issues that are currently labeled as Elliott Wave 4 in an overall upward wave direction. The primary usage of this scan is to identify Type 1 Buy opportunities that are setting up.

Elliott Wave 5 Up

This identifies issues that are currently labeled as Elliott Wave 5 in an overall upward wave direction. The primary usage of this scan is to identify Type 2 Sell opportunities that are setting up.

Elliott Wave 5 Down

This identifies issues that are currently labeled as Elliott Wave 5 in an overall downward wave direction. The primary usage of this scan is to identify Type 2 Buy opportunities that are setting up.

MACD

The Moving Average Convergence/Divergence (MACD) is an oscillator technique attributed to Gerald Appel. The MACD consists of an oscillator that is the point spread difference between two exponential moving averages with different periods, and a moving average of that oscillator. (An exponential moving average is an average that weighs recent data more heavily at a geometric rate than data from the distant past.) Signals are generated by the relationship of the two values.

The Moving Average Convergence/Divergence (MACD) indicator is used in three variations. MACD is used as an indicator to determine overbought or oversold conditions in a market. MACD can be used to generate signals on line crossovers, and it can generate oscillator divergence signals. It is similar to the RSI and Stochastics in its usage, where divergences between the MACD and prices may indicate an upcoming trend reversal.

The primary MACD usage: When the MACD is increasing, prices are trending higher; when the MACD is decreasing, prices are trending lower. A buy signal is given when the MACD graph is in an oversold condition below the origin and the MACD line crosses above the signal line. A sell signal (negative breakout) is given when the MACD graph is in an overbought condition above the origin and the MACD line falls below the signal line. The important crossovers of the MACD line to the signal line occur far from the zero line (the horizontal axis). The amount of divergence between the MACD line and the signal line is important; the greater divergence, the stronger the signal.

Other ways MACD is used: It is also popular to buy/sell when the MACD goes above/below zero. When the shorter moving average pulls away dramatically from the longer moving average, the price may be overextending, indicating the creation of a possible "overbought/oversold" condition. Divergence analysis is helpful near the end of a current trend when the MACD diverges. A bearish divergence occurs when the MACD is making new lows while prices fail to reach new lows. A bullish divergence occurs when the MACD is making new highs while prices fail to reach new highs. Both of these divergences are most significant when they occur at relatively overbought/oversold levels.

The MACD is said to be effective in wide-swinging trading markets. For more volatile markets, some MACD users may shorten the calculation periods of the exponential moving averages.

MACD Above

This identifies issues where the MACD oscillator of the difference between a 26-period exponential moving average and a 13-period exponential moving average is above the signal line of a 9 period moving average of the oscillator.

MACD Below

This identifies issues where the MACD oscillator of the difference between a 26-period exponential moving average and a 13-period exponential moving average is above the signal line of a 9 period moving average of the oscillator.

MACD Crossed Above

This identifies issues where the MACD oscillator of the difference between a 26-period exponential moving average and a 13-period exponential moving average has crossed above the signal line of a 9 period moving average of the oscillator.

MACD Crossed Below

This identifies issues where the MACD oscillator of the difference between a 26-period exponential moving average and a 13-period exponential moving average has crossed below the signal line of a 9 period moving average of the oscillator.

Moving Averages

A moving average is an indicator that shows the average value of an issue over a specific time period. For example, a six period moving average would take the sum value (often the closing price of the bar) over six days, compute the sum, and divide by six. The longer the length of the moving average, the slower it reacts to the market and, conversely, the shorter the moving average, the more sensitive the moving average will be to a price change.

Some ways moving averages can be used are to "smooth-out" price fluctuations and help emphasis the direction of a trend, if even a minor trend. For example, if a price is above a moving average, speculators and investors tend to buy; if a price is below a moving average, speculators and investors tend to sell.

Moving averages can be displaced, or offset, by a given number of bars – this is called a displaced moving average, or DMA. It is frequently meaningful when the current price crosses the DMA.

For Advanced GET Users:

The "6/4 Moving Average" is the same thing as the "6/4 DMA Channeling" technique, which is referred to in the Advanced GET manual, seminar video tapes, and demo disk. It combines two moving averages, which have slight variations, and says that trend reversal is not complete unless both the moving averages are crossed.

The "6/4 Moving Average Cross Up" scan helps identify those issues that are higher probability candidates for a trend reversal. The 6/4 DMA Channeling technique should be used with a Type 1 or 2 Buy or Sell setup to help confirm that trend reversal. A "6/4 Moving Average Crossing Up" scan is also useful in identifying early Type 1 and 2 Buy signal setups.

To manually create a "6/4 Moving Average" in the Advanced GET program, go to the Moving Average menu, and create two moving averages. Both moving averages will have a "Length" set to "6" and the "Offset" set to "4." The difference between the two moving averages will be to set one moving average "Source" to "High" and change the color to "Blue;" the other set the "Source" to "Low" and make "Red" the color.

6/4 Moving Average Above

This identifies issues whose current price is above a 6/4 moving average. A 6/4 moving average is a 6 period moving average using the "High" as the sum value, offset by 4 periods. The primary usage of this scan is to confirm buying strategies, such as a Type 1 Buy or a Type 2 Buy.

6/4 Moving Average Below

This identifies issues whose current price is below a 6/4 moving average. A 6/4 moving average is a 6 period moving average using the "Low" as the sum value, offset by 4 periods. The primary usage of this scan is to confirm selling strategies, such as a Type 1 Sell or a Type 2 Sell.

6/4 Moving Average Cross Up

This identifies issues where the current bar has crossed above a 6/4 moving average. A 6/4 moving average is a 6 period moving average using the "High" as the sum value, offset by 4 periods. A crossover of a moving average and the closing prices of the bars on the chart is usually taken as an entry or exit signal.

6/4 Moving Average Cross Down

This identifies issues where the current bar has crossed below a 6/4 moving average. A 6/4 moving average is a 6 period moving average using the "Low" as the sum value, offset by 4 periods. A crossover of a moving average and the closing prices of the bars on the chart is usually taken as an entry or exit signal.

20 Moving Average Above

This identifies issues whose current price is above a 20 period movining average using the close as the sum value.

20 Moving Average Below

This identifies issues whose current price is below a 20 period movining average using the close as the sum value.

50 Moving Average Above

This identifies issues whose current price is above a 50 period movining average using the close as the sum value.

50 Moving Average Below

This identifies issues whose current price is below a 50 period movining average using the close as the sum value.

100 Moving Average Above

This identifies issues whose current price is above a 100 period movining average using the close as the sum value.

100 Moving Average Below

This identifies issues whose current price is below a 100 period movining average using the close as the sum value.

200 Moving Average Above

This identifies issues whose current price is above a 200 period movining average using the close as the sum value.

200 Moving Average Below

This identifies issues whose current price is below a 200 period movining average using the close as the sum value.

Oscillator Pullback

This identifies issues whose 5/35 Oscillator is pulling back to zero. The pullback to zero is defined as a retracement of the oscillator to between 90 & 140% from it's peak during Elliott Wave 3. The primary usage of this scan is to signify the end of the Elliot Wave 4.

Oscillator Pullback Negative

This identifies issues whose 5/35 Oscillator is pulling back to zero. The pullback to zero is defined as a retracement of the oscillator to between 90 & 140% from it's peak during Elliott Wave 3. The primary usage of this scan is to signify the end of the Elliot Wave 4.

This identifies issues whose 5/35 Oscillator is pulling back to zero from the Negative direction.

Oscillator Pullback Positive

This identifies issues whose 5/35 Oscillator is pulling back to zero. The pullback to zero is defined as a retracement of the oscillator to between 90 & 140% of the previous oscillator. The primary usage of this scan is to signify the end of the Elliot Wave 4.

This identifies issues whose 5/35 Oscillator is pulling back to zero from the Positive direction.

PTI

PTI is a proprietary indicator designed to help identify if "normal" profit taking is going on in a major Wave 4 pullback. Wave 4 corrections are "profit taking" sequences. A Wave 4 pullback is considered a higher probability trade setup because if the Wave 4 pullback maintains control, it will lead most often to a major Wave Five completion of that five wave sequence. The key is the profit-taking must be "normal" and the PTI is one important indicator that helps gauge that Wave 4 profit-taking action.

PTI> 35

This identifies issues with a Profit Taking Index (PTI) greater than 35, which is the minimum value for normal profit taking in a Wave 4.

Regression Trend Channels

A Regression Trend Channel (RTC) is simply the mathematically standard deviation of the linear regression. The RTC is made up of three parallel lines. The center line is a linear regression. This center line is bracketed by two additional lines that represent the standard deviation of the linear regression price data. The RTC is calculated using the actual prices of the bars in the trend.

How to Use RTC:

The break of a RTC represents a change in trend or a change in bias and so can be used as an entry or exit signal.

In many ways it is similar to a moving average. The difference with the RTC there is there is no lagging the linear regression trendline and, secondly, it is helpful because it often identifies a change in trend or bias more quickly than a moving average.

Terms: A linear regression trend line is the straight-line mathematical measurement of the relationship between sets of price data that plot out as a trend line. More simply, a linear regression trend line is a straight line that best fits a set of points. With bar charts the points used to calculate the trend line can be derived in many different ways. For example they can based on the high, low, or midpoint of the bars.

A standard deviation is a measure of the dispersion of a frequency distribution that is the square root of the arithmetic mean of the squares of the deviation of each of the class frequencies from the arithmetic mean of the frequency distribution. What is important for our purposes is that one standard deviation from the mean captures 68% of all observations and two standard deviations captures 95% of all observations (assuming normal distribution).

Regression Trend Channels (Break Down)

Identifies isIdentifies issues where the current price is below the lower channel. The lower channel is positioned 2 standard deviations below the linear regression trend line. The linear regression trend line is based on the "H-L" flip of the bars from the last primary or major pivot - which means the low point of the bars is used for an up trend, and the high point of the bars are used are used in a down trend.

Regression Trend Channels (Break Up)

Identifies issues where the current price is above the upper channel. The upper channel is positioned 2 standard deviations above the linear regression trend line. The linear regression trend line is based on the "H-L" flip of the bars from the last primary or major pivot - which means the low point of the bars is used for an up trend, and the high point of the bars are used are used in a down trend.

Stochastic

The Stochastic indicator is a momentum indicator developed by George Lane. It is designed to indicate when the market is "overbought" or "oversold." Lane’s premise is that when a price increases, the closing prices tend to move toward the daily highs and, conversely, when a market’s price decreases, the closing prices move toward the daily lows.

A Stochastic indicator is plotted as two lines, the "%K" line and "%D" line. %K is calculated by finding the highest and lowest point in a trading period and then finding where the current close is in relation to that trading range. %K is then smoothed with a moving average. %D is a moving average of %K. Stochastic uses a range scale of 0 to 100. Any move of the %K and %D line above 80 (some use 75) is considered approaching an "overbought" condition, where the price is close to a top. Any move of the %K and %D line below 20 (some use 25) is considered approaching an "oversold" condition, where the price is close to a bottom.

A general sell signal is generated when you have a crossover of the %K and the %D when both are above the band set at 80 (or 75). A general buy signal is generated when you have a crossover of the %K and the %D when both are below the band set at 20 (or 25). A more reliable signal occurs when the %K and %D has already turned from the extreme to the direction of the new trend when that %K and %D crossover takes place.

The are a few general observations about the Stochastic indicator: (1) the %K line will often change direction before the %D line, but when the %D line changes direction prior to the %K line, a slow and steady reversal may often be expected; (2) when both %K and %D lines change direction and the faster %K line subsequently changes direction to retest a crossing of the %D line but does not cross it, stability of the prior reversal may occur; (3) when a strong move is underway and the indicator reaches its extremes around 0 and 100, a following pullback often retests these extremes, and provides a better buy or sell signal; (4) Many times, when the %K or %D lines reaches the extremes of the 0 to 100, and it begins to flatten out, it makes it harder to identify when the next trend will occur.

Stochastic Above 75

This identifies issues where the Stochastic (set at a 21 period %K = 3% and %D = 3) lines are above 75. A Stochastic reading above 75 is considered approaching an "overbought" condition, where the current price action may be close to a top.

Stochastic Below 25

This identifies issues where the Stochastic (set at a 21 period %K = 3% and %D = 3) lines are below 25. A Stochastic reading below 25 is considered approaching an "oversold" condition, where the current price action may be close to a bottom.

False Bar

The False Bar is a proprietary indicator that looks to improve on trading signals given by the Stochastic indicator. If the Stochastic indicator is giving an overbought or oversold situation these signals are not valid if the False Bar is present. In Advanced GET, these bars are displayed graphically on the Stochastic study as a bar either above or below the Stochastic lines.

Stochastic NFB Above 75

This identifies issues where the Stochastic (set at a 21 period %K = 3% and %D = 3) lines are above 75. A Stochastic reading above 75 and no False Bar is present is considered approaching an "overbought" condition, where the current price action may be close to a top.

Stochastic NFB Below 25

This identifies issues where the Stochastic (set at a 14 period %K = 3% and %D = 3) lines are below 25. A Stochastic reading below 25 and no False Bar is present is considered approaching an "oversold" condition, where the current price action may be close to a bottom.

XTL

The XTL (eXpert Trend Locator) is a study developed by Tom Joseph that uses a statistical evaluation of the market. The XTL is designed to tell the difference between random market swings (noise) and directed market swings (trends).

The XTL is a simple but powerful tool that is not complicated to use. When there is no major trend, the bars are plotted as regular bars in black (no trend). As soon as a potential trend is detected, the color of the bar is changed to Red (downtrend) or Blue (up trend). If the bars are blue in color, then the trend is up. If the bars are red in color, then the trend is down. The first bar to change from a regular bar to an up trend or downtrend is called a breakout bar.

XTL Breakout Bar

This identifies issues that are potentially changing into a new trend, and that may be in the early stages of a new up trend or downtrend.

Because these types of setups can happen quickly-- depending on the time frame you are analyzing -- using this scan selection can save valuable time. It can help improve an XTL breakout trading opportunity by allowing you to use this extra time to further investigate the real risk-verses-reward potential using other Advanced GET tools and studies, Type 1 or 2 Buy or Sell techniques or methodologies

XTL Down

This identifies issues that are currently in a XTL downtrend. The primary usage of this scan is to identify either the early stages of a downtrend or an existing downtrend.

When used in conjunction with Elliot Wave analysis, the most valuable use for the XTL is to identify the early stages of a Wave 3 type rally or decline. Elliott Wave analysis alerts the user of a potential change-in-trend, and the XTL detects or identifies this change-in-trend. Since the XTL is a Statistical model and does not use Elliott Wave logic, it provides an independent confirmation and early entry tool for Wave 3 type swings. Thus, the combination of Elliott Wave analysis and the XTL provides the added luxury of both anticipating and confirming the trend.

XTL Up

This identifies issues that are currently in a Blue XTL up trend. The primary usage of this scan is to identify either the early stages of an up trend or an existing up trend.

When used in conjunction with Elliot Wave analysis, the most valuable use for the XTL is to identify the early stages of a Wave 3 type rally or decline. Elliott Wave analysis alerts the user of a potential change-in-trend, and the XTL detects or identifies this change-in-trend. Since the XTL is a Statistical model and does not use Elliott Wave logic, it provides an independent confirmation and early entry tool for Wave 3 type swings. Thus, the combination of Elliott Wave analysis and the XTL provides the added luxury of both anticipating and confirming the trend.