Advanced GET Studies - GET Elliott Waves

Overview The GET Elliott Waves study, the "E" part of GET (Gann Elliott Trader), is one of the core studies of Advanced GET. The simplified Elliott Wave theory states that you will have a 5 wave sequence in a direction, some kind of corrective pattern (most of the time), and then a new 5 wave sequence in the opposite direction.

The GET Elliott Waves study is used in conjunction with the GET Elliott Oscillator to determine Type One and Type Two trades. Please note that you must

purchase Advanced GET to access this study.

How do I apply the GET Elliott Waves study?

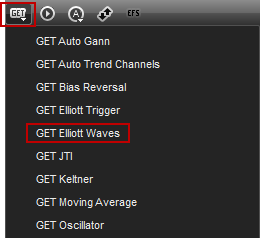

To apply this study to a chart, left-click on the GET icon and select GET Elliott Waves from the drop-down menu.

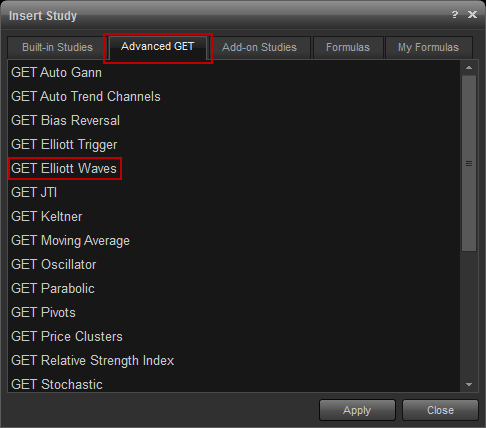

alternatively, you can also right-click on the chart, when the menu appears, left-click on

insert study, left-click on the

advanced get tab and then select

get elliott waves.

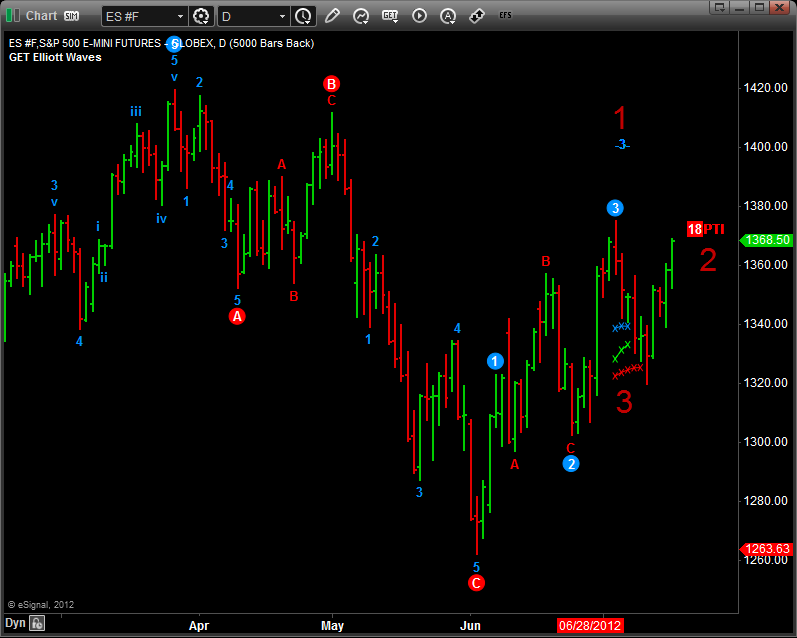

The GET Elliott Waves study will then appear on the price pane of the chart.

In addition to labeling the Elliott Waves on the chart, the GET Elliott Waves study also provide (1) fibonacci projections for the current wave, (2) the Profit Taking Index (PTI) which appears automatically on the chart after Wave 3 is completed, and (3) Wave 4 Channel Lines which also appear automatically on the chart after Wave 3 is completed.

Properties

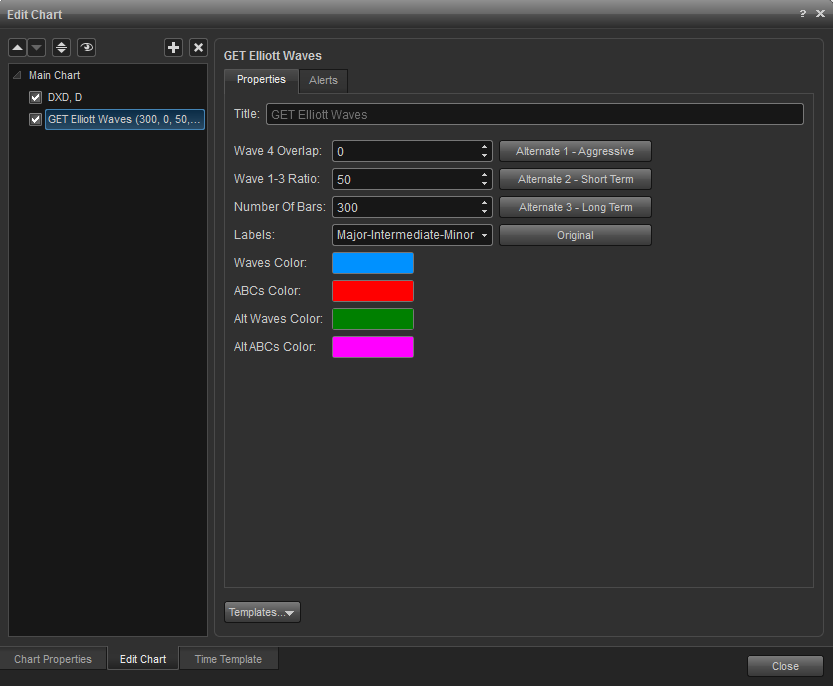

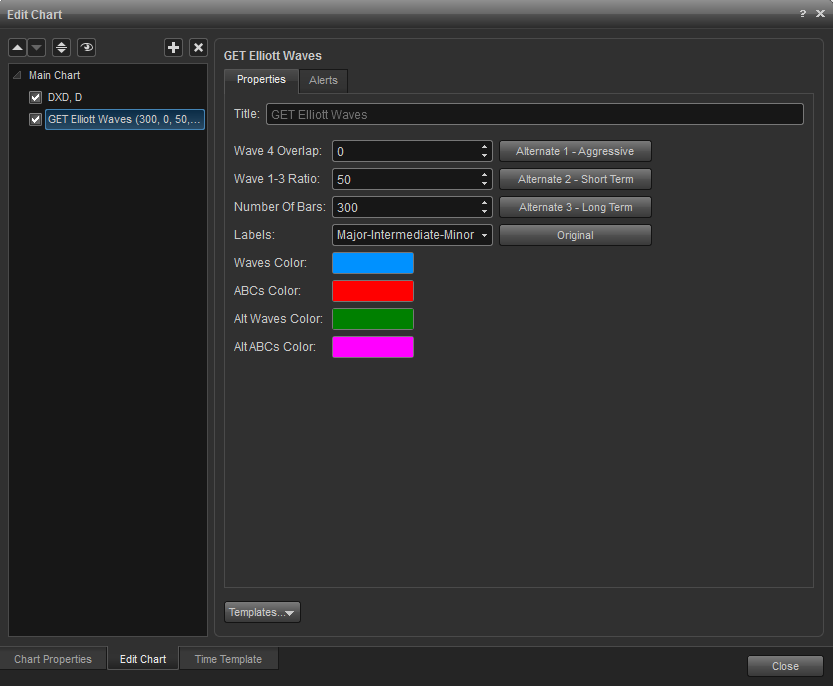

To edit the GET Elliott Waves study parameters, either right-click on the chart and select Edit Chart or right-click on any of the wave labels of the study and select Edit.

The Wave 4 Overlap: Indicates the percentage that Wave 4 can overlap Wave 1 before the Wave count is considered invalid and has to be recalculated. The default for any Futures contract is 17% (to account for slippage) and 0% for all other issues.

The Wave 1-3 Ratio: Indicates the maximum % level of the length of Wave 3 that the Wave 1 can be labeled. This percentage is important in the way the Wave 4 time channels and PTI are calculated. The default Wave 1-3 ratio is 50%. This means if you take the length of Wave 3, the Wave 1 could be labeled anywhere up to 1/2 the length of Wave 3. This does not mean that it will be labeled right at the 50% mark, but it could be labeled anywhere from the 1% up to 50% level according to this percentage. If you decrease this number to 20%, this means that the Wave 1 has to be labeled somewhere between 1% and 20% of the length of Wave 3.

Number of Bars: To obtain the optimum wave count, we recommend using between 300 - 600 bars of data. Once you are experienced with how the wave counts are affected by pivots, using 150 or more bars is acceptable for a wave count. Caution: Using less than 150 bars or more than 800 bars of data might result in inconsistent or bad wave counts.

Labels: This setting allows you to select what degrees of Elliott Wave counts are displayed on the chart. Major labels are identified as large numbers inside of disks. Intermediate labels are smaller numbers. Minor labels are small Roman numerals.

Waves Color: The color in which the Waves 1-5 will be labeled.

ABCs Color: The color in which the ABC corrective waves will be labeled.

Alt Waves Color: The color in which the alternate Waves 1-5 will be labeled.

Alt ABCs Color: The color in which the alternate ABC corrective waves will be labeled.

Alternate 1 - Aggressive: When on, indicates that you will have an aggressive change in the Elliott Waves. You will want to use this setting when you are watching a Wave 4 in progress, and the Elliott Wave Oscillator has not only pulled back to the zero line, but has crossed the zero line and has retraced over the zero line more than 38%.

Alternate 2 - Short Term: When on, indicates that a shorter Elliott Wave count should be used. The Short Term count could be used to see a 5 Wave sequence inside of a strong Wave 3.

Alternate 3 - Long Term: When on, indicates that a much longer Elliott Wave count than normal should be used. This count should be used when the market fails to move strongly away from the end of a 5 Wave sequence. The Long Term count can look at the market on a bigger picture when this happens to determine if the end of the previous Wave 5 might have really been the end of a Wave 3, with a Wave 5 still to be placed. This wave count should be used with the Alternate 3 Oscillator and not with the 5,35 Oscillator.

Original: Returns the Wave 4 settings and Wave 1-3 setting, along with the Elliott Waves, back to their original settings.

Alerts

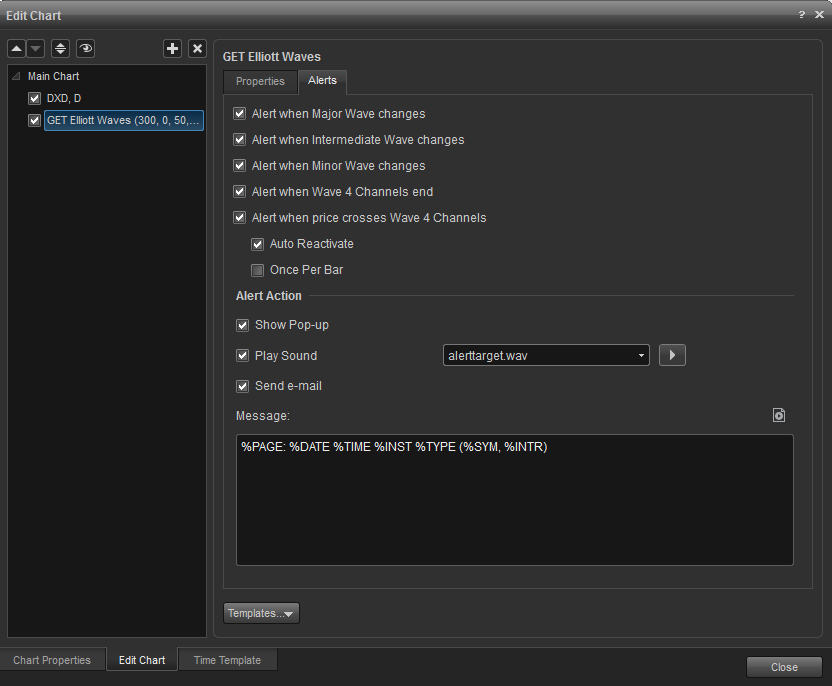

Select the Alerts tab to set an alert for when a Major, Intermediate, and Minor waves change count and also Wave 4 Channels end or prices crosses them.

Auto Reactivate: When checked, the alert will reactivate so it can be triggered again.

Once per Bar: When checked, the alert will not trigger again until the price bar forms.

Alert Action: When an alert is triggered you can choose the method for how you wish to be alerted. Settings include a pop up alert, an audio alert (custom .wav file can be set), and if configured, an e-mail alert message.