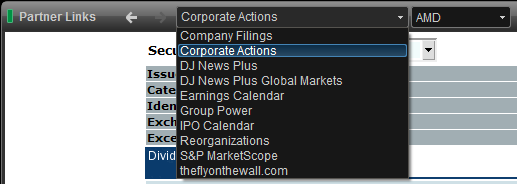

Overview of Corporate Actions

A Corporate Action is any event that brings material change to a company and affects its stakeholders. This includes shareholders, both common and preferred, as well as bondholders. Splits, dividends, mergers, acquisitions and spinoffs are all examples of corporate actions.

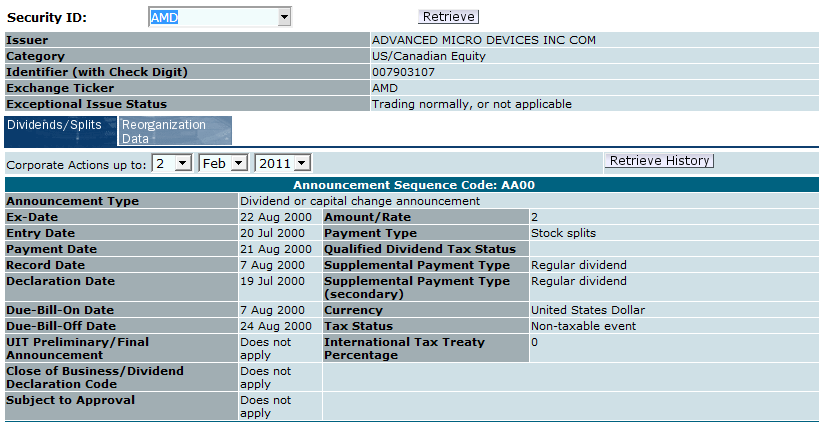

once the window opens, you can enter a different symbol into the security id field. there are 2 selectable tabs, dividends/splits and reorganization data. the dividends/splits tab allows you to select specific dates in which annoucement type, ex-date, entry data info will be displayed. the reorganization data tab provides information pertaining to acquisitions and mergers.

we carry several years of history on the majority of publicly traded companies from the u.s. and canada. we currently do not have corporate actions research content available for any european, south america or asia/pacific equity markets.

history data

For U.S. and Canadian equities, we process all splits and reverse splits and adjust the “previous” price for the first day of trading following the split of shares. We also adjust the daily history for these splits so gaps are removed and proper technical analysis can be applied to our charts. In general, we do not adjust for dividends.

For the London Stock Exchange (LSE), splits and reverse splits are processed and applied to our daily history but they are not currently in the file to apply for intraday charts. Also, the previous price is not adjusted in the feed for the first post-split trading day so for a more accurate daily change figure, you may want to calculate the change off the “open” (right click on the change column, choose “compute change” and select “from open”). Also, we do not adjust for dividends.