Setting an Alert

Several methods exist for calculating the pivot point (P) of a market. Most commonly, it is the arithmetic average of the high (H), low (L), and closing (C) prices of the market in the prior trading period.

P = (H + L + C) / 3

Sometimes, the average also includes the previous period's or the current period's opening price (O):

P = (O + H + L + C) / 4

Support and Resistance Levels

Price support and resistance levels are key trading tools in any market. Their roles may be interchangeable, depending on whether the price level is approached in an up-trending or a down-trending market. These price levels may be derived from many market assumptions and conventions. In pivot point analysis, several levels, usually three, are commonly recognized below and above the pivot point. These are calculated from the range of price movement in the previous trading period, added to the pivot point for resistances and subtracted from it for support levels.

The first and most significant level (S1) and resistance (R1) is obtained by recognition of the upper and the lower halves of the prior trading range, defined by the trading above the pivot point (H - P), and below it (P - L). the first resistance on the up-side of the market is given by the lower width of prior trading added to the pivot point price and the first support on the down-side is the width of the upper part of the prior trading range below the pivot point.

R1 = P + (P - L) = 2 x P - L

S1 = P - (H - P) = 2 x P - H

Thus, these levels may simply be calculated by subtracting the previous low (L) and high (H) price, respectively, from twice the pivot point value.

The second set of resistance (R2) and support (S2) levels are above and below, respectively, the first set. They are simply determined from the full width of the prior trading range (H - L), added to and subtracted from the pivot point, respectively:

R2 = P + (H - L)

S2 = P - (H - L)

Commonly a third set is also calculated, again representing another higher resistance level (R3) and a yet lower support level (S3). The method of the second set is continued by doubling the range added and subtracted from the pivot point:

R3 = H + 2 x (P - L)

S3 = L - 2 x (H - P)

This concept is sometimes, albeit rarely, extended to a fourth set in which the tripled value of the trading range is used in the calculation.

Qualitatively, the second and higher support and resistance levels are always located symmetrically around the pivot point, whereas this is not the case for the first levels, unless the pivot point happens to divide the prior trading range exactly in half.

Applying Pivot Points

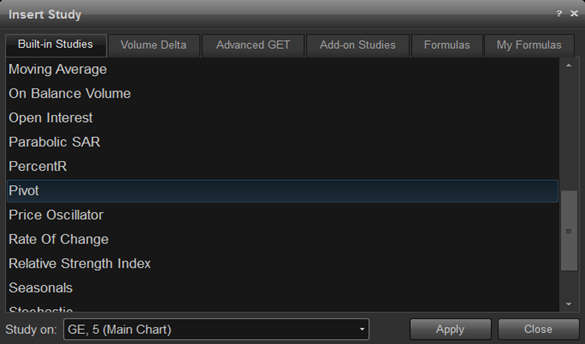

To apply Pivot Points study to a chart, left-click the built-In Studies icon, select Pivot, click Apply and Close.

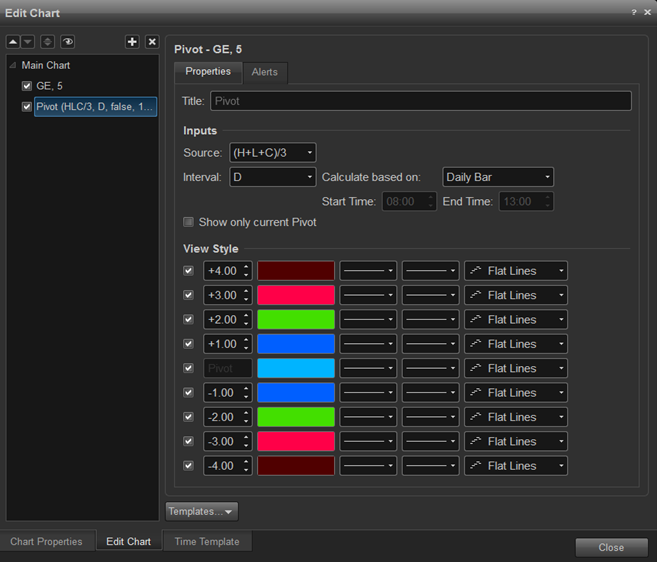

To edit the Pivot Points settings, right-click the mouse inside the chart and click Edit Chart. Click the Properties tab.

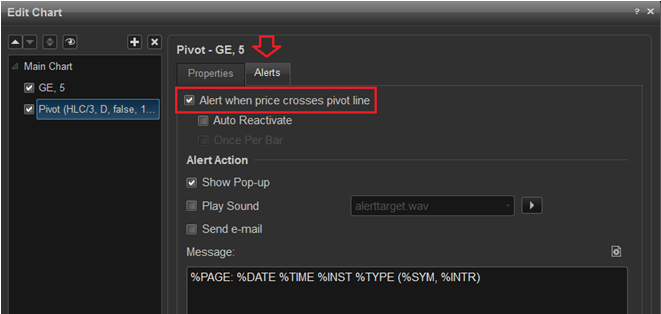

To set an alert that will trigger when the price approaches the support and resistance levels, right-click the mouse inside the chart and click Edit Chart and click the Alerts tab.