esignal - data - cbot bond & note pricing

can you explain the pricing esignal uses for bonds and notes on the chicago board of trade?

we receive futures data from the cbot in a decimal format which we in turn change to fractions to match exchange specs. the first couple of digits is the whole future's price and the next 2-3 are a fraction of the whole number.

for example:

us h4 (30 year us treasury bonds) may be shown in esignal as 11227. this is actually 112 and 27/32. the first 3 digits are a whole number, and the last two digits are a fraction (32nds) of the whole number.

ty h4 (10 year us treasury notes) may be shown in esignal as 114205. this is actually 114 and 20/32 and 1/64. the first 3 digits are a whole number, the second two are a fraction (32nds) of the whole number, and the last digit is a fraction of a 32nd. the last digit is "half 32nds". it is either a 5 or 0. a 5 would indicate a half 32nd.

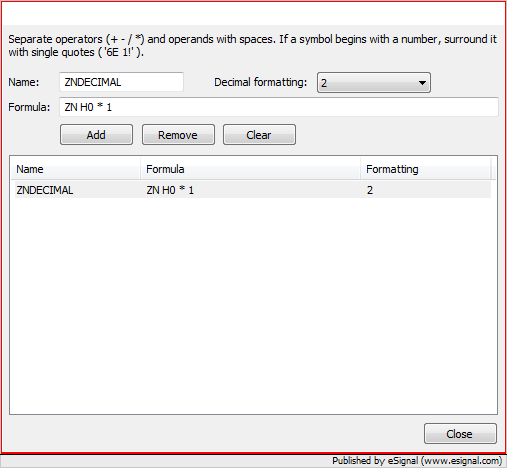

how can i display these symbols in decimals? use the spread symbol engine to convert these symbols from fractions to decimals. click tools, spread symbol settings to launch the spread engine. in this example we've converted the 10 year treasury note to fractions by entering zn h0 *1 under formula and assigning the name zndecimal.

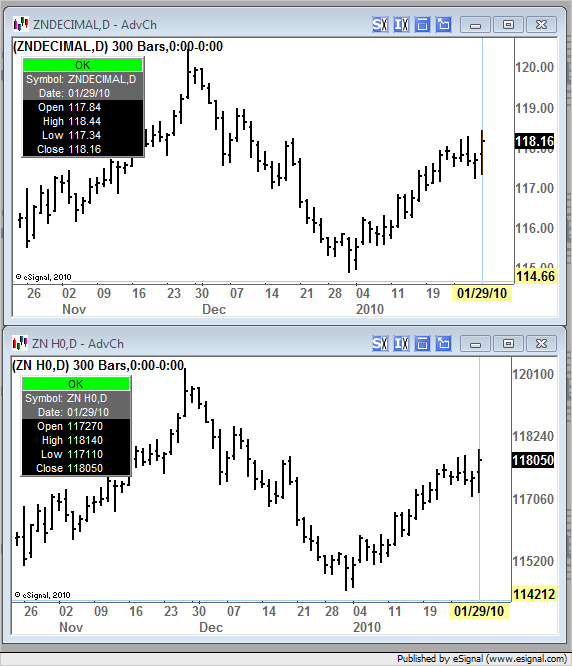

for comparison purposes here is a chart of decimals (top) vs. fractions for zn h0.

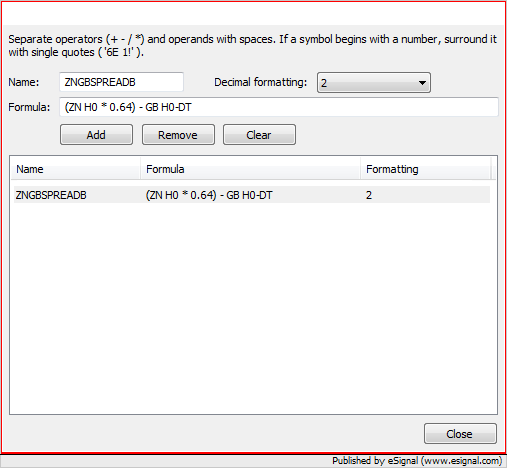

can i create a spread of the cbot bonds/notes vs. another symbol? yes, use the spread symbol engine to create the appropriate multiplier. in this case we've used the 10 year note and multipled by .64 by entering (zn ho * 0.64) into the first half of the equation. from there use the "-" operand to complete the formula. in this case we are creating a spread which calculates the difference between the 10 year note and the bund (gb h0-dt).

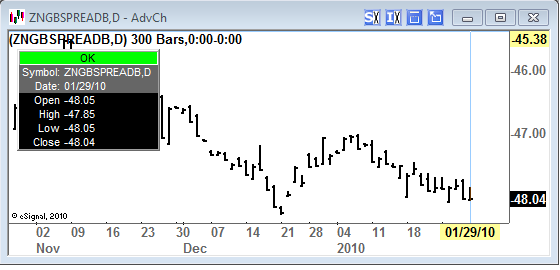

here is what the spread will look like when entered into a chart.

can you explain the pricing esignal uses for bonds and notes on the chicago board of trade?

we receive futures data from the cbot in a decimal format which we in turn change to fractions to match exchange specs. the first couple of digits is the whole future's price and the next 2-3 are a fraction of the whole number.

for example:

us h4 (30 year us treasury bonds) may be shown in esignal as 11227. this is actually 112 and 27/32. the first 3 digits are a whole number, and the last two digits are a fraction (32nds) of the whole number.

ty h4 (10 year us treasury notes) may be shown in esignal as 114205. this is actually 114 and 20/32 and 1/64. the first 3 digits are a whole number, the second two are a fraction (32nds) of the whole number, and the last digit is a fraction of a 32nd. the last digit is "half 32nds". it is either a 5 or 0. a 5 would indicate a half 32nd.

how can i display these symbols in decimals? use the spread symbol engine to convert these symbols from fractions to decimals. click tools, spread symbol settings to launch the spread engine. in this example we've converted the 10 year treasury note to fractions by entering zn h0 *1 under formula and assigning the name zndecimal.

for comparison purposes here is a chart of decimals (top) vs. fractions for zn h0.

can i create a spread of the cbot bonds/notes vs. another symbol? yes, use the spread symbol engine to create the appropriate multiplier. in this case we've used the 10 year note and multipled by .64 by entering (zn ho * 0.64) into the first half of the equation. from there use the "-" operand to complete the formula. in this case we are creating a spread which calculates the difference between the 10 year note and the bund (gb h0-dt).

here is what the spread will look like when entered into a chart.