Overview

Opening a Money Management Planner Window

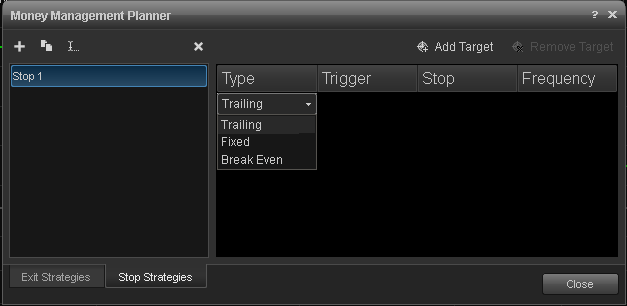

Money Management Planner Toolbar Components

Exit Strategies

Stop Strategies

Applying the Money Management Strategy to an Order

Money Management Strategy FAQs

Overview

The Money Management Planner, in combination with the Trade Manager and Chart Trading, allows traders to apply pre-defined, sophisticated, and automated money management strategies to a position when it is opened. The money management strategies consist of exit strategies and/or stop strategies to be applied when the primary order is executed.

Note: Money Management Strategies are not supported for FXCM, Interactive Broker Financial Advisor (FA) Accounts, MB Trading, and TransAct due to API limitations. Broker APIs must provide average price calculations in order for MM Strategies to perform correctly. This calculation is not provided by the eSignal application at this time.

Exit Strategies

Applying the Money Management Strategy to an Order

This exit strategy can now be added to any order you're placing by either using an order ticket or the Trade Manager.

The Order Ticket

Select a strategy from the dropdown menu on the right side of the order ticket labeled Exit Strategy.

Trade Manager

Opening a Money Management Planner Window

Money Management Planner Toolbar Components

Exit Strategies

Stop Strategies

Applying the Money Management Strategy to an Order

Money Management Strategy FAQs

Overview

The Money Management Planner, in combination with the Trade Manager and Chart Trading, allows traders to apply pre-defined, sophisticated, and automated money management strategies to a position when it is opened. The money management strategies consist of exit strategies and/or stop strategies to be applied when the primary order is executed.

Note: Money Management Strategies are not supported for FXCM, Interactive Broker Financial Advisor (FA) Accounts, MB Trading, and TransAct due to API limitations. Broker APIs must provide average price calculations in order for MM Strategies to perform correctly. This calculation is not provided by the eSignal application at this time.

Opening a Money Management Planner Window

To open a Money Management Planner window, on the main menu bar, click Trade, then Money Management Planner.

Exit strategies are used to exit a position in a specified manner either through a profit target or stop loss or a combination of them.

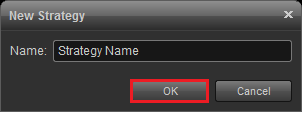

Creating a new exit strategy

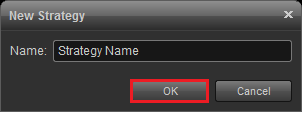

To create a new exit strategy, click the + (plus sign) on the title bar. In the New Strategy box, enter a name for the strategy and click OK.

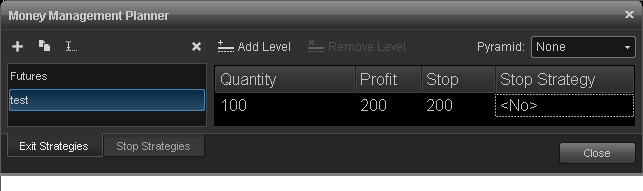

The next step is to set the parameters of your money management strategy.

Quantity: Number of shares/contracts being managed at this level.

Profit: The number of ticks from the entry price where the sell limit order will be placed if long, or the buy limit order, if short.

Stop: The number of ticks from the entry price where the stop order will be placed.

Stop Strategy: Select No to apply a no stop strategy, New to create a new stop strategy, or select an existing stop strategy.

Add Level: Creates a level of the exit strategy.

Remove Level: Removes the highlighted level of the exit strategy.

Pyramid: This setting is used when adding to or decreasing your current position with an associated money management strategy.

None: Apply no pyramiding strategy.

Adj. Qty Only: Adjust the quantity of shares/contracts with pyramid strategy.

To create a new exit strategy, click the + (plus sign) on the title bar. In the New Strategy box, enter a name for the strategy and click OK.

The next step is to set the parameters of your money management strategy.

Quantity: Number of shares/contracts being managed at this level.

Profit: The number of ticks from the entry price where the sell limit order will be placed if long, or the buy limit order, if short.

Stop: The number of ticks from the entry price where the stop order will be placed.

Stop Strategy: Select No to apply a no stop strategy, New to create a new stop strategy, or select an existing stop strategy.

Add Level: Creates a level of the exit strategy.

Remove Level: Removes the highlighted level of the exit strategy.

Pyramid: This setting is used when adding to or decreasing your current position with an associated money management strategy.

None: Apply no pyramiding strategy.

Adj. Qty Only: Adjust the quantity of shares/contracts with pyramid strategy.

Adj. Qty & Price: Adjust the quantity and price of shares/contracts with pyramid strategy.

Set the parameters for each of the fields and click Close.

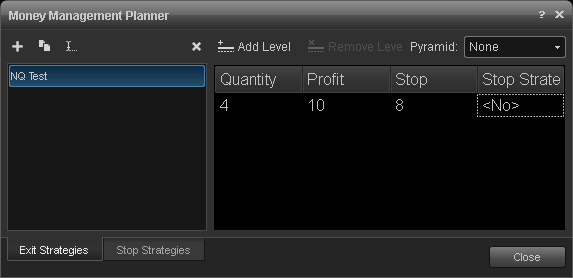

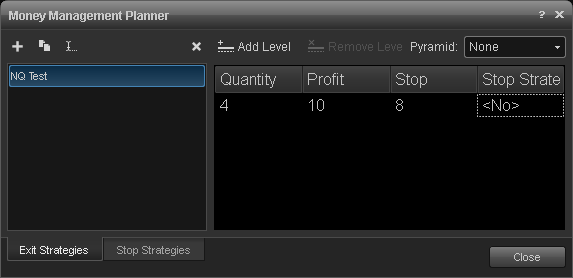

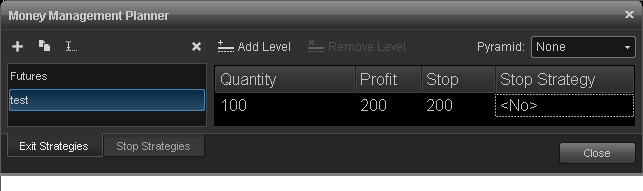

Example of How to Create an Exit Strategy without a Stop Strategy

Here's an example of how an exit strategy works on a single level exit:

We want to go long 4 contracts of NASDAQ (NQ) E-Mini.

We want to set a Stop Loss at 8 ticks from the entry price.

We want to set a profit target to close the position 10 ticks from the entry.

Here is what the Strategy would look like with these settings:

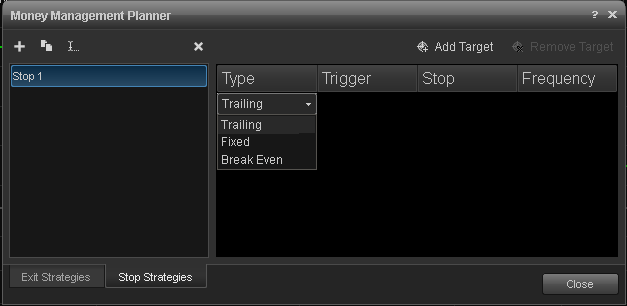

Stop Strategies

Stop strategies allow users to automatically adjust the primary stop based on settings in the Stop Strategy window to better manage profits. A stop strategy allows you implement trailing stops, break even stops, and fixed stops.

Creating a Stop Strategy

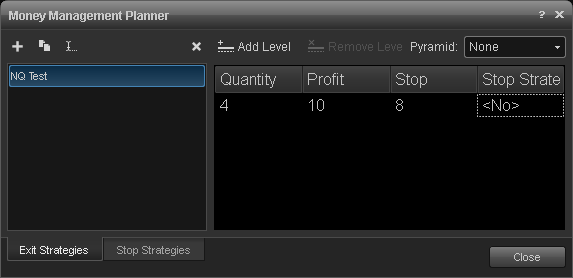

When setting up a new exit strategy, users can select either "No", "New" or a previously created strategy. Selecting "New" allows new stop strategies to be created.

A Stop Strategy dialog window will appear ready for the user to enter the appropriate values needed to complete the stop strategy.

Stop strategies allow users to automatically adjust the primary stop based on settings in the Stop Strategy window to better manage profits. A stop strategy allows you implement trailing stops, break even stops, and fixed stops.

Creating a Stop Strategy

When setting up a new exit strategy, users can select either "No", "New" or a previously created strategy. Selecting "New" allows new stop strategies to be created.

A Stop Strategy dialog window will appear ready for the user to enter the appropriate values needed to complete the stop strategy.

Type: There are three types of stops for the Stop Strategy,

Trailing: A trailing stop once triggered, will continue to move to the new stop levels at the

Trailing: A trailing stop once triggered, will continue to move to the new stop levels at the

frequency you set.

Fixed Stop: A fixed stop is triggered only once and remains at the new stop level

Break Even: A Break even stop is much like the fixed stop, however it moves the stop order to

Fixed Stop: A fixed stop is triggered only once and remains at the new stop level

Break Even: A Break even stop is much like the fixed stop, however it moves the stop order to

where you entered the trade.

Trigger: Number of ticks the trade must go before the stop strategy executes.

Stop: Number of ticks the stop strategy will move away from the last traded price when initiated.

Frequency: The number of ticks a trade can continue in a profitable direction after the trigger before the trailing stop will move again.

Add Target: Creates a new level for the Stop Strategy.

Remove Target: Removes the highlighted Stop Strategy level.

Trigger: Number of ticks the trade must go before the stop strategy executes.

Stop: Number of ticks the stop strategy will move away from the last traded price when initiated.

Frequency: The number of ticks a trade can continue in a profitable direction after the trigger before the trailing stop will move again.

Add Target: Creates a new level for the Stop Strategy.

Remove Target: Removes the highlighted Stop Strategy level.

Once the parameters for the stop strategy are set, click the Exit Strategies tab and select the newly created stop strategy to associate with the exit strategy and click Close. When the primary order is filled and the parameters of the stop strategy have been met, the initial stop order will adjust to it's new level.

Example of combining a Stop Strategy with an Exit Strategy

Using the NQ Test example above, after the primary order has been filled, the exit strategy (NQ Test) is executed with a Stop Order placed 8 ticks below the Entry Price and a Limit Order placed 10 ticks above it. Once the position gets 10 ticks in the money, the stop will be adjusted from original 8 ticks to now 5 ticks below the current price and the stop will be moved up every time the position goes 2 ticks further into the money.

Applying the Money Management Strategy to an Order

This exit strategy can now be added to any order you're placing by either using an order ticket or the Trade Manager.

The Order Ticket

Select a strategy from the dropdown menu on the right side of the order ticket labeled Exit Strategy.

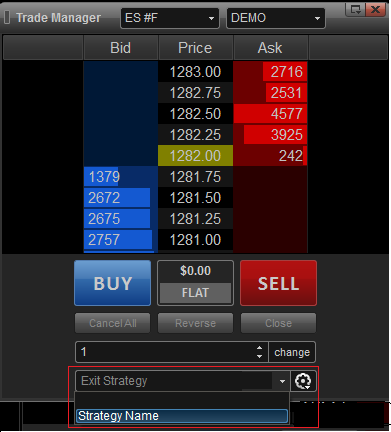

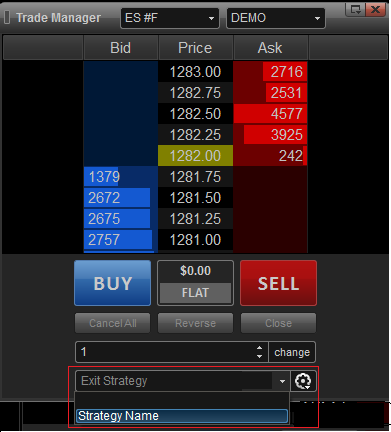

Trade Manager

To open a Trade Manager window, click New, then Trade Manager from the main menu. A keyboard shortcut(Ctrl+0) is also available.

Select the strategy from the dropdown menu and then click the Buy or Sell buttons:

Money Management Strategy FAQs

I'm trading stocks and set my stop to 10. What does the 10 represent?

Money Management Strategy FAQs

I'm trading stocks and set my stop to 10. What does the 10 represent?

This would represent a 10 tick stop loss from the entry price. Since the minimum tick for most stocks is .01, this would represent a stop loss at .10 (.01 x 10). For futures such as the e-Mini S&P, the minimum tick increment is .25, so a 10 tick stop would be 2.50.

When i place a trade with an MMS associated with it, I don't see the stop loss or profit target on the charts.

When i place a trade with an MMS associated with it, I don't see the stop loss or profit target on the charts.

Before the MMS takes effect, the primary order must first be filled. Once it's filled, you'll see the other order(s) appear in the different trade windows.