A continuous contract is a futures symbol that ties the historical data of the previous front month contracts all on the same chart. It's designed to piece the trading activity of the most active contracts together, and then chart that activity to spot long term trends. These symbols will work in any window. However, we recommend that you use them in daily charts for long term trend analysis. By their own nature, continuous contracts usually have gaps at the There are several formats available for tracking continuous contracts (also called continuation charts). The formats (explained below) include the root symbol along with #F or 1! (with variations to the 1! format).

#F Format

This format uses the root symbol followed by a space then #F (in place of the month and year code). For example, ES #F, CL #F, US #F. The current, most active contract will generally mirror the data you see on the #F symbol in a quote sheet. #F symbols are available for US-based futures contracts only. For global futures (such as Europe or Asia) we suggest using the 1! format.

1! Format

This format uses the root symbol followed by a space then 1! (in place of the month and year code). This format supports global futures such as the DAX. Simply add the exchange extension to the end. For the DAX Future the format would be AX 1!-DT. Using 1! always gives you the current front month contract. Use 2! the second nearest contract and 3! for the 3rd nearest (etc).

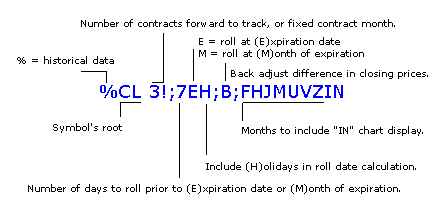

% Format

This format is a variation of the 1! format but contains additional parameters that can be specified. This format contains several segments that begin with a % sign followed by the root symbol, a space, 1! (or 2!, 3! depending on which contract month you wish to specify). There are additional segments which are spelled out below. If parameters for a certain segment are not set, the segment will not appear.

First segment %

The first segment contains the the symbol's root, preceded by the percent (%) sign. This identifies the chart as a continuation chart. The chart header also defines the number of contracts forward to track, or the fixed contract month. The front month is always defined as 1!.

Using the example above, if the front month for the contract is April, a 3! in the chart header indicates that the contract being tracked is June. If a fixed month was chosen, the month's designation appears (in the example above, the month "Z", or December, will be used to construct the chart from each year).

Second Segment 7EH

The second segment identifies how the roll date for the contract is calculated. The roll date may either be

calculated by subtracting a number of days from the contract's = (E)xpiration date, or from the contract's (M)onth of expiration. The chart header also defines whether or not holidays that fall within the time series will be included in the roll date calculation.

Using the above example, the roll date is calculated by subtracting 7 days from the contract's (E)xpiration date. Any (H)olidays that fall within those seven days will be included in the roll date calculation.

Third Segment B

The third segment identifies whether prices will be back adjusted at roll date. If a B is present in the chart header, price data will be back adjusted as follows:

On the last day of trading when the contract will roll, the application takes the difference between the close on the current contract and the close on the next contract out. This difference is then applied to all prices going back in time on the chart. As a result, any differences that you see in contract prices at roll date is the real difference in price, and not the price difference due to the cost of money.

Fourth Segment FHJMUVZIN

The fourth segment identifies the months to include "IN" the historical data displayed on the chart. Certain contracts, such as copper, allow trading on more months than activity may warrant. The result can show a month with very low activity as compared to others. When these months display in a chart, it can result in a distortion of the price activity that a trader may want to focus on. Using these parameters, you may specify what months to include in the data display.

3rd Party Support

Our internal testing indicates that the % formats are compatible with back adjusted historical charts (Daily, Weekly, Monthly intervals) for 3rd Party applications. Continuous contracts for intraday intervals (minute or tick bars) are not available for 3rd party use. Using the format below, users can specify contract month (i.e. front month, 2nd month out, etc), rollover date, which contracts to include, etc. To stream real-time data into 3rd party apps, please be sure to use the non-continuous contract symbol (i.e. ES Z1, CL H2, etc). Note: if the % format is not compatible with your 3rd Party application, you will to contact the vendor of the application to request that they modify their API to be compatible with it.

Examples of Continuation Chart Headers

The table below illustrates some examples of continuation chart headers, and how they are interpreted. All examples use the root CL (Crude Oil) as the symbol selected.

| Example | Interpretation |

| %CL 1! | Nearest futures continuation chart |

| %FDAX 1!-EUX | Nearest futures continuation chart including international symbol format |

| %CL Z! | Nearest futures continuation chart, constructed using a fixed month "Z" (December) for each year. |

| %CL 2!;5EH | Second contract out; roll 5 days before the expiration date, include any holidays in that 5 day count. |

| %CL 1!;1M | Nearest futures continuation chart, roll 1 day before the expiration month. |

| %CL 2!;10MH | Second contract out; roll 10 days before the expiration month, include any holidays in that 10-day count. |

| %CL 1!;7E;HMUZIN | Nearest futures continuation chart; roll 7 days before the expiration date; includes only the March, June, September, and December contracts. |

With a continuation chart you may:

- Identify the number of contracts forward to track. If the front month of crude oil is April, using a "3"

designation will track the June contract as the current contract instead. If the front month for US Treasury - Bonds is September 2007, using a "3" designation will track the March 2008 contract as the current

contract - Explicitly use only a given month each year, e.g., a continuation chart based on December contracts

- Define when the contract will roll (a number of days before the expiration date, or a number of days before the month of expiration)

- Define whether holidays should be included in determining when the contract should roll

- Back adjust data at roll, using the difference between the closing price on the current contract and the

closing price on the next month out - Explicitly define the contract months to include in the historical data display (allows you to filter out months where trading activity is very low on certain contracts).