What is the Rally Scan?

Rally Scan is available through the Turbo Package only. At approximately 10:30 a.m. EST and again at 2:30 p.m. EST, big Wall Street money pushes hot stocks up and sour stocks down. It's the law of supply and demand and it happens every day! This extremely intelligent and accurate scanner captures every big move of the day. Discover breakout opportunities in real time to learn which stocks are hot trades for the day. Learn which stocks are exceeding important highs and lows set in the first hour of trading and then again after noon.

how high does a stock have to go before it gets included in the rally scan?

the current price of the stock just has to be greater than the highest price of the stock during the first hour of trading. there is no minimum percentage or limit in the price of the stock before it gets included in the scan, the price just has to be higher than the highest price during the first hour of trading.

what is trading scan and the breakout scan in the rally scanner and what is the main difference between the two?

the trading scans rank the results by order of magnitude with the largest moves listed first. these scans will identify those stocks that have had large moves above or below a range either following the first hour of trading or following the trading at noon.

the breakout scans will identify those stocks that are just breaking above or below a range either following the first hour of trading or following the trading at noon. the stocks closest to the breakout level are ranked first.

the main difference between the trading scan and the breakout scan is the order they are sorted. the breakout scan sorts the data and puts those issues that have exceeded the high by the smallest amout/percent at the top of the list. the trading scan takes the same data and sorts it so those issues that have exceeded the high by the most amount/percent are at the top. the list of issues for the breakout scan is the same list of issues in the trading scan in reverse order.

how to add the market scanner to your services:

the rally scan is included in the turbo package. please click here for price information. you can add this service through account maintenance. for rally scan data for nasdaq, you must add the nasdaq exchange to your services.

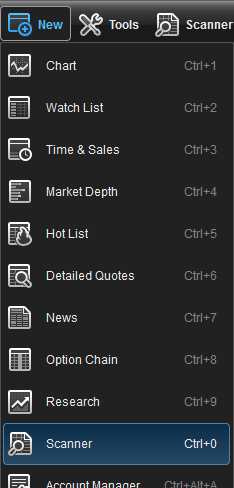

opening a rally scanner

the rally scanner can be opened within the esignal program by clicking on new, then scanner from the main menu bar.

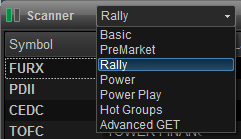

select rally in the upper left hand corner of the scanner window.

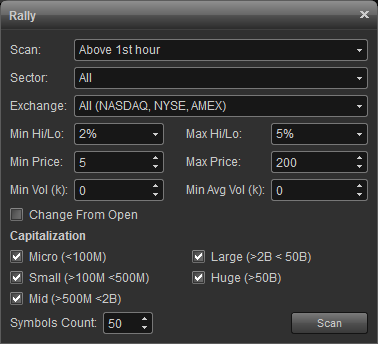

scan type

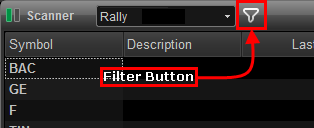

you can access the different scan types by clicking on the filter icon located at the top of the scanner window.

the following scans provide a list of stocks using the following criteria:

there are two types of scans - trading and breakout.

the trading scans rank the results by order of magnitude with the largest moves listed first. these scans will identify those stocks that have had large moves above or below a range either following the first hour of trading or following the trading at noon.

trading:

above 1st hour: lists stocks that are trading much higher since 10:30 am et.

below 1st hour: lists stocks that are trading much lower since 10:30 am et.

above noon: list stocks that are trading much higher since the trading at noon et.

below noon: list stocks that are trading much lower since the trading at noon et.

above final hour: list stocks that are trading much higher since 3:00 pm et.

below final hour: list stocks that are trading much lower since 3:00 pm et.

the breakout scans will identify those stocks that are just breaking above or below a range either following the first hour of trading or following the trading at noon. the stocks closest to the breakout level are ranked first.

breakout:

1st hour high: list stocks that are trading slightly higher since 10:30 am et.

1st hour low: list stocks that are trading slightly lower since 10:30 am et.

noon high: list stocks that are trading slightly higher since noon et.

noon low: list stocks that are trading slightly lower since noon et.

final hour high: list stocks that are trading slightly higher since 3:00 et.

final hour low: list stocks that are trading slightly lower since 3:00 et.

the main difference between the trading scan and the breakout scan is the order they are sorted. the breakout scan sorts the data and puts those issues that have exceeded the high by the smallest amout/percent at the top of the list. the trading scan takes the same data and sorts it so those issues that have exceeded the high by the most amount/percent are at the top. the list of issues for the breakout scan is the same list of issues in the trading scan in reverse order.

sector

allows you to view stocks belonging to certain sectors or industry groups.

issues

all all stocks

ipo(<2 wks) stocks that have ipo'd within the last 2 weeks

ipo(2 wks - 3 mos) stocks that have ipo'd between 2 weeks and 3 months ago

ipo(3 mos - year) stocks that have ipo'd between 3 months and 1 year ago

min/max price

allows you to set price brackets (ie., minimum/maximum dollar value per share) to focus on stocks best suited to your trading needs.

min/avg volume

the min volume is used to select stocks whose premarket trade volume exceeds the specified value. for example: if min volume is set to 100k, this means a stock has to trade over 100,000 shares since the market closed on the previous day to be included in the scan.

the avg volume is used to select stocks whose last 20 day average volume exceeds the specified value. for example: if avg volume is set to 2000k, this means a stock has to trade over 2,000,000 shares average per day over the last 20 days to be included in the scan. helpful for weeding out very thinly traded stocks whose movements are not supported by sufficient volume for trading.

change from open

by default the scan results are calculated base of the previous days close. choose this option if you would like your scan results to be base off the open price, instead of the previous days close.

market cap

allows you to eliminate stocks whose market capitalization are outside the specified boundaries.

symbol count

allows you to set the number of issues that are displayed at one time. if you are seeing too few results you may want to change your search criteria. if you have a full page of results and want to have more displayed on each page, you can choose the number of rows from the drop down list in the table section at the bottom of the scanner page.

scanner properties

right-click the scanner window and select properties to access the scanner properties menu which includes the following:

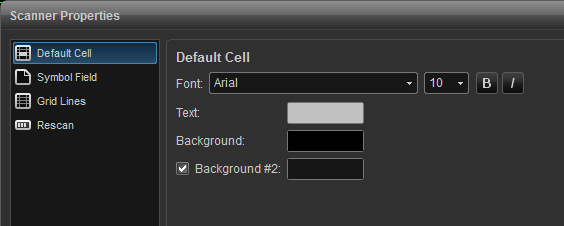

default cell

the default cell menu allows you to specify the font type and size along with a button for bold and italics. there are color settings which include text and background. background #2 is checked if you prefer alternating colors for each row.

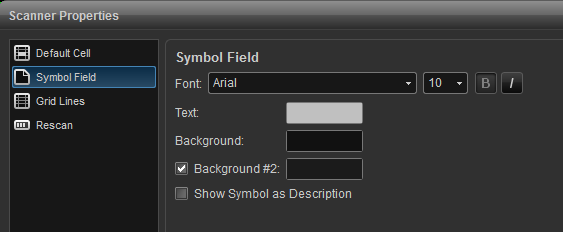

symbol field

change fonts, colors, and toggle between displaying the symbol or description of the listed issues. background #2 is checked if you prefer alternating colors for each row. you can opt to show symbol as description which will display the description vs. the symbol.

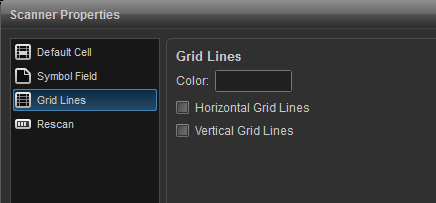

grid lines

use this menu to add vertical and horizontal grid lines and to customize the grid line color.

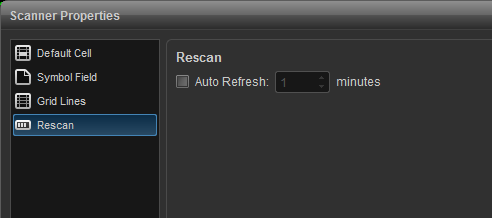

rescan

use this menu to turn on auto refresh. auto refresh forces the database to be re-scanned in the selected interval.

please click on the link below to access the various esignal market scanner strategies.

http://www.esignal.com/education/likepro/strategy/default.asp

*please note that the scanner only scans the market for us stocks.