Paper trading allows you to test trading strategies and make simulated trades without risking actual funds. This unique tool gives you the ability to view prospective trades and refine strategies in a test environment in real time. This article will provide the basics to get you started with paper trading in the eSignal program.

Configuring eSignal Paper Trading

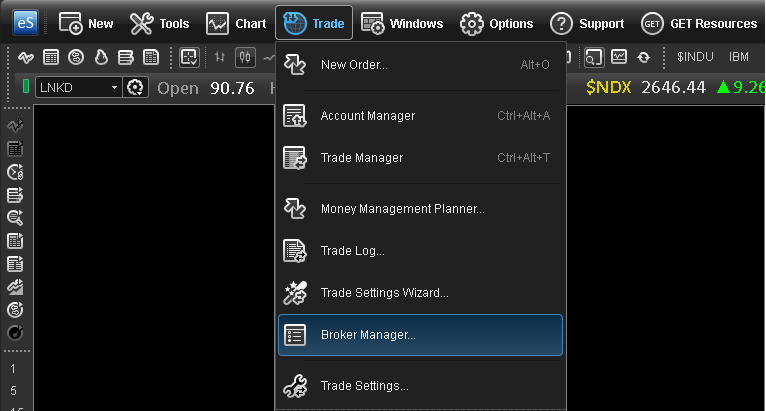

To set up the beginning balance amount and trading scenarios you will be using with eSignal Paper Trading, click on Trade from the main menu and select Broker Manager.

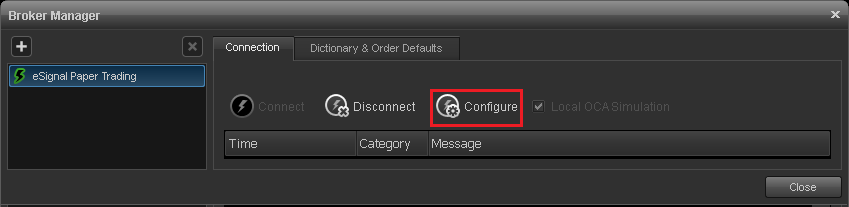

Highlight eSignal Paper Trading in the left pane. On the Connection tab, click Configure.

The Configure eSignal Paper Trading dialog box will appear:

Balance: The amount of capital you will be starting the account with.

Simulated Order Fills: The options for how you would like the orders that are placed, to be filled.

Complete Fills - One Part: Number of shares traded will be done as one complete order.

Complete Fills - Two Parts: First part of a partial fill and the second will complete the order.

Partial Fills - 50%: Only 50% of the order will be completed the other 50% will be canceled.

All Option in Random Sequence: Uses all options above to fill orders in no specific order.

Clear orders: When the box is checked, it will remove any working, cancelled and filled order from your Paper Trading account.

Clear Positions: When box is checked, all positions are removed.

eSignal Paper Trading Reset

To reset the eSignal paper trading, check the Clear Orders and Clear Positions boxes and re-enter the balance once again.

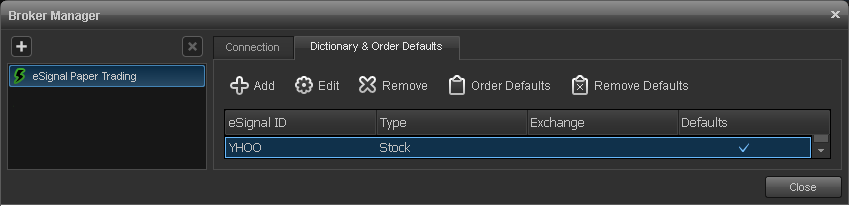

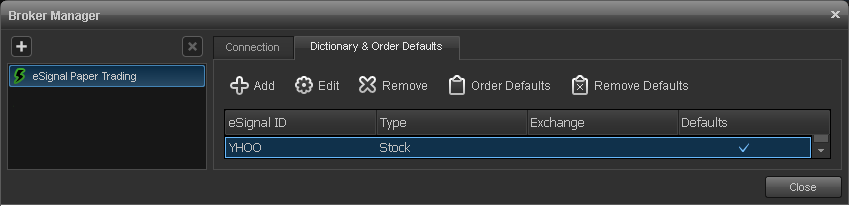

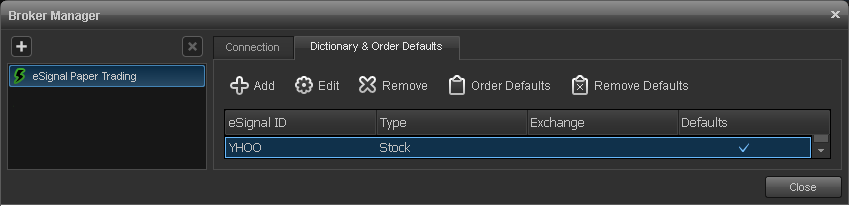

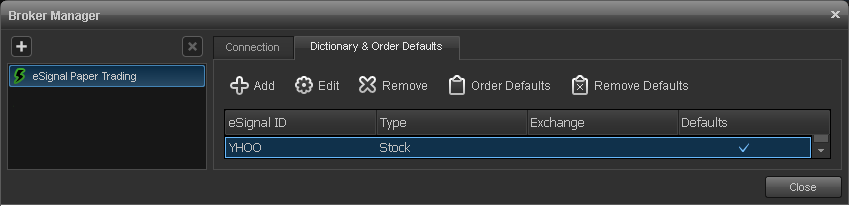

Dictionary & Order Defaults Tab

The Dictionary & Order Defaults tab is where symbols are added, edited, and removed from the broker dictionary. It's also where specific symbols or asset classes can be chosen to act as the default when placing a trade. For eSignal Paper Trading, there is no need to edit the Broker Dictionary, symbols will be added and or removed based on the symbols in your active pages.

Add: Adds new symbols to the Broker Dictionary.

Edit: Edits an existing symbol in the Broker Dictionary

Remove: Removes the highlighted symbol(s) in the Broker Dictionary.

Order default: Sets some of the pre-defined variable for the highlighted individual symbols or asset class.

Remove Default: Removes the pre-defined variables from the highlighted symbol or asset class.

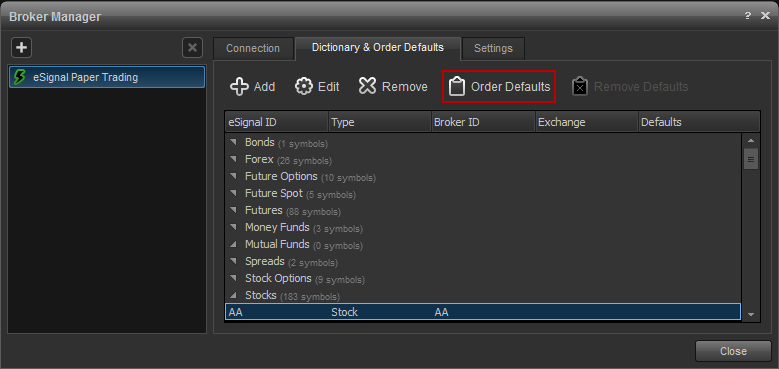

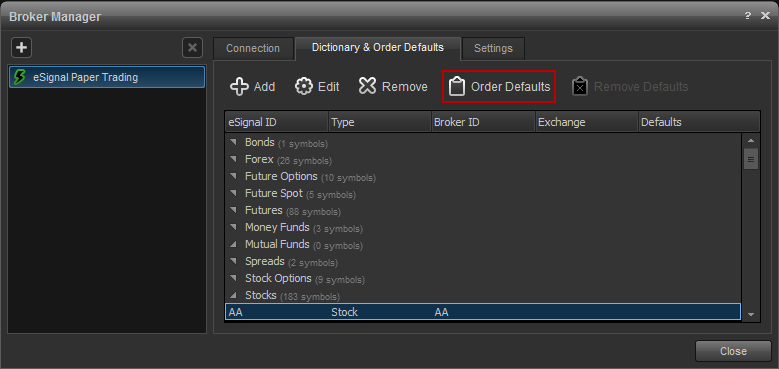

Order Defaults

Pre-set order defaults allow you to assign variables like quantity and the type of order in advance. You can set defaults for an asset class such as stocks and futures or for an individual symbol (YAHOO, for example).

To set the order default highlight either the asset class or an individual symbol (aa is used for this example), click Order Defaults.

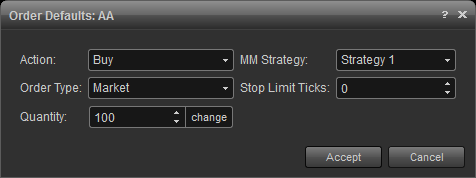

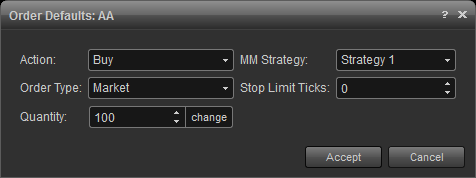

The Order Defaults dialog box will appear to enable you to set the order defaults for the selected issue:

:

:

Action: Select buy or sell order.

Order Type: Select Market, Limit, Stop, or Stop Limit.

Quantity: Enter the number of shares or contracts.

MM Strategy: Set Money Management Strategy to be applied, if any.

Stop Limit Ticks: if Stop Limit is the default order type, you can set how many ticks away from the stop price that the limit price will be set.

Set the appropriate variables for your trading style and click Accept. A checkmark will appear in the Defaults column of the symbol that the order defaults are applied to.

Data Simulator

The Data Simulator allows you to recreate trading scenarios using simulated data. This tool allows you to test strategies with a specific market trend in mind. It can be especially useful in paper trading or testing strategies outside of normal market hours. To learn more click here.

Balance: The amount of capital you will be starting the account with.

Simulated Order Fills: The options for how you would like the orders that are placed, to be filled.

Complete Fills - One Part: Number of shares traded will be done as one complete order.

Complete Fills - Two Parts: First part of a partial fill and the second will complete the order.

Partial Fills - 50%: Only 50% of the order will be completed the other 50% will be canceled.

All Option in Random Sequence: Uses all options above to fill orders in no specific order.

Clear orders: When the box is checked, it will remove any working, cancelled and filled order from your Paper Trading account.

Clear Positions: When box is checked, all positions are removed.

eSignal Paper Trading Reset

To reset the eSignal paper trading, check the Clear Orders and Clear Positions boxes and re-enter the balance once again.

Dictionary & Order Defaults Tab

The Dictionary & Order Defaults tab is where symbols are added, edited, and removed from the broker dictionary. It's also where specific symbols or asset classes can be chosen to act as the default when placing a trade. For eSignal Paper Trading, there is no need to edit the Broker Dictionary, symbols will be added and or removed based on the symbols in your active pages.

Add: Adds new symbols to the Broker Dictionary.

Edit: Edits an existing symbol in the Broker Dictionary

Remove: Removes the highlighted symbol(s) in the Broker Dictionary.

Order default: Sets some of the pre-defined variable for the highlighted individual symbols or asset class.

Remove Default: Removes the pre-defined variables from the highlighted symbol or asset class.

Order Defaults

Pre-set order defaults allow you to assign variables like quantity and the type of order in advance. You can set defaults for an asset class such as stocks and futures or for an individual symbol (YAHOO, for example).

To set the order default highlight either the asset class or an individual symbol (aa is used for this example), click Order Defaults.

The Order Defaults dialog box will appear to enable you to set the order defaults for the selected issue:

:

:Action: Select buy or sell order.

Order Type: Select Market, Limit, Stop, or Stop Limit.

Quantity: Enter the number of shares or contracts.

MM Strategy: Set Money Management Strategy to be applied, if any.

Stop Limit Ticks: if Stop Limit is the default order type, you can set how many ticks away from the stop price that the limit price will be set.

Set the appropriate variables for your trading style and click Accept. A checkmark will appear in the Defaults column of the symbol that the order defaults are applied to.

Data Simulator

The Data Simulator allows you to recreate trading scenarios using simulated data. This tool allows you to test strategies with a specific market trend in mind. It can be especially useful in paper trading or testing strategies outside of normal market hours. To learn more click here.