Advanced GET Studies - GET Oscillator

Overview

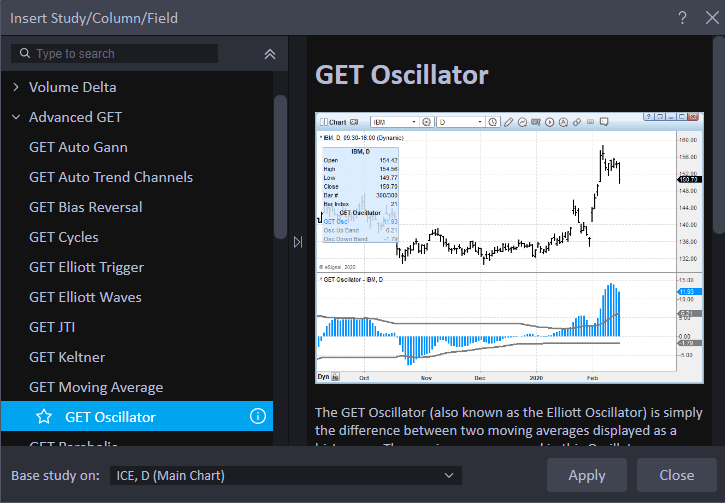

The GET Oscillator (also known as the Elliott Oscillator) is simply the difference between two moving averages displayed as a histogram. The moving averages used in this Oscillator are simple moving averages with 5 and 35 as the default values.

This study is used in conjunction with the GET Elliott Waves study and is to qualify the accuracy of the wave count. In a 5 Wave sequence the GET Oscillator should pull back to the zero line to signify the end of the Wave 4. Under normal conditions you will want to use the GET Oscillator 5, 35 setting. When the market is going into an extended 5th Wave, you should use the 5,17 Oscillator (Extended) setting. When using the Alternate Count 3 - Long Term Elliott Wave setting, you should use the 10,70 setting (Alternate 3).

The Osc Up and Down Bands are a proprietary indicator which qualify Wave 3. If the program is labeling a movement in the market as a Wave 3, the GET Oscillator should be above the Osc Up Band in an up trend and below the Osc Down Band in a down trend. If the GET Oscillator does not exceed the Osc Up and Down Bands, then there is a good chance that the market is not really in a Wave 3 and that the program will relabel the Elliott Wave count.

Please note that you must purchase Advanced GET to access this study.

How do I apply the Auto Trend Channel study?

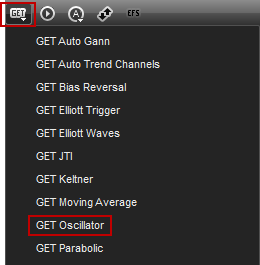

To apply this study to a chart, left-click on the GET icon and select GET Oscillator from the drop-down menu:

To apply this study to a chart, left-click on the GET icon and select GET Oscillator from the drop-down menu:

Alternatively, you can also right-click on the chart, when the menu appears, left-click on Insert Study, left-click on the > symbol next to the Advanced GET tab and then select GET Oscillator.

Properties

To edit the GET Oscillator study parameters, either right-click on the chart and select Edit Chart or right-click on any of the lines of the study and select Edit.

Moving Average 1: Select the number of periods to use in the calculation of the moving average.

Moving Average 2: Select the number of periods to use in the calculation of the moving average.

Strength %: number box allows you to adjust where the Osc Up and Down Bands will be drawn. If the % is set to 100, then the Osc Up and Down Bands will be drawn exactly at the level where they were calculated. If the % is set to 110, then the Osc Up and Down Bands will be drawn at a level that is 10% higher than they were actually calculated (moving them away from the zero line). If the % is set to 60, then the Osc Up and Down Bands will be drawn at a level that is 40% lower than they were actually calculated (moving them closer to the zero line).

Tom's Osc: Changes the moving averages to a 5 period moving average against a 35 period moving average.

Extension: Changes the moving averages to a 5 period moving average against a 17 period moving average.

Alternate 3: Changes the moving averages to a 10 period moving average against a 70 period moving average.

Alerts

Select the Alerts tab to set an alert for when the GET Oscillator crosses the Osc Up or Down Bands or crosses the zero line.

Auto Reactivate: When checked, the alert will reactivate so it can be triggered again.

Once per Bar: When checked, the alert will not trigger again until the price bar forms.

Alert Action: When an alert is triggered you can choose the method for how you wish to be alerted. Settings include a pop up alert, an audio alert (custom wav file can be set), and if configured, an e-mail alert message.

Once per Bar: When checked, the alert will not trigger again until the price bar forms.

Alert Action: When an alert is triggered you can choose the method for how you wish to be alerted. Settings include a pop up alert, an audio alert (custom wav file can be set), and if configured, an e-mail alert message.