The scanner technology offers both technical and fundamental scanners on 35 exchanges with variable time frames. A preset library of scans makes it easy to get started and allows you to easily customize your own scans to discover new opportunities in the market.

Technical and fundamental scanning – Conduct scans on 33 built-in technical analysis studies and 45 fundamental fields (US equities only) with variable time frames and expressions on a dozen global exchanges. Build your library of scans and mix and match scanning criteria to discover new trading ideas.

To take advantage of this powerful and free scanner, download and install eSignal available here.

In addition to this article, there are two videos available demonstrating the Market Screener Plus, Introduction to Market Screener Plus and Market Screener Plus.

Does Market Screener Plus include pre-market activity? No, Market Screener Plus is designed for use with regular trading hours.

How much is the Market Screener?

eSignal subscribers running eSignal can access the Market Screener for free with the number of exchanges based on the product as shown below:

eSignal subscribers running eSignal can access the Market Screener for free with the number of exchanges based on the product as shown below:

• eSignal Classic - 1 Exchange (Free)

• eSignal Signature - 3 Exchanges (Free)

• eSignal Elite - 5 Exchanges (Free)

Once you've selected the exchange(s) you wish to follow, you won't be able to select a different exchange until the following day. You are free to change your selected exchange once per day. Add-ons are available to upgrade the total number of exchanges.

Once you've selected the exchange(s) you wish to follow, you won't be able to select a different exchange until the following day. You are free to change your selected exchange once per day. Add-ons are available to upgrade the total number of exchanges.

Visit Account Maintenance to for pricing to upgrade the number of exchanges for Market Screener Plus.

Password - Special Characters Not Allowed

Please note Market Screener Plus is not compatible with eSignal passwords that contain special characters (#, !, @, etc). Please remove any special characters from your eSignal password in order to use Market Screener Plus. You can reset your eSignal password by clicking here.

Once you have installed eSignal 12 or newer, you must select an exchange(s). Click Options on the main menu followed by Application Properties. Select Market Screener Plus and click the Change button. Only those exchanges that you currently subscribe to (i.e. pay exchange fees for) will be selectable. The exchange will be grayed out if it's not currently a part of your eSignal subscription. By default, you'll only be able to choose 1 exchange per day unless you upgrade your Market Screener to allow multiple exchanges. Select the exchange(s) you wish to follow and click OK.

After an exchange or exchanges have been selected, click New on the main menu and select Market Screener Plus.

Standard and Text Modes

The scan criteria can be displayed in the default Standard mode or in Text mode.

Standard Mode (click on the gear icon to edit parameters):

Text Mode (click on the colored links to edit parameters):

To change modes, you can click on the Application Properties link (see above image) or click Options, then Market Screener Plus, and click the drop down menu for View Mode:

Dynamic vs Static Display: If Dynamic is checked, all the symbols will be Streaming in Real-Time with each symbol counted towards your symbol limit. If Dynamic is unchecked the symbols will be in Static mode where the symbols will not update or count against your symbol limit.

Summary Mode: Displays multiple column headings in the same row which allows more symbols to be displayed in the same space.

Copy: Allows you to copy a symbol or symbols to another window, such as a Watch List window.

Select All: Allows you to select all the symbols in the Hot List window to another window.

Properties: See Properties below.

Undo/Redo: Undo or redo changes that were made.

Copy: Allows you to copy a symbol or symbols to another window, such as a Watch List window.

Select All: Allows you to select all the symbols in the Hot List window to another window.

Properties: See Properties below.

Undo/Redo: Undo or redo changes that were made.

The next step is to select the filter criteria to scan on. Scans can be performed based on a list of symbols, exchanges, customized expressions, bar values, fundamental data, and technical indicators.

Filter Menu

Click the gear icon to display the Filter Menu:

New Filter: Creates a new filter.

Save Filter: Saves the current filter.

Save Filter As: Saves the current filter with a new name.

Import Filter: Imports an external filter file. Filter files have the extension: .esff

Export Filter: Exports the current filter to a filter file.

Rename Filter: Renames the current filter.

Duplicate Filter: Creates a duplicate version of the current filter.

Reload Filter: Reloads the current filter.

Remove Filter: Removes the current filter from the filter list.

Click here for more information on importing and exporting filters.

Default filters

On the title bar of the Market Screener, you'll find a drop down menu of sample filters.

The default filters include:

• 4 Day Gain

• 4 Day Loss

• 5 Day Volume Decrease

• 5 Day Volume Increase

• 52 week high

• Average_Xover

• Bearish Engulfing

• Bearish Harami

• Bullish Engulfing

• Bullish Harami

• Gap Up

• MACD Bearish Cross

• MACD Bullish Cross

• Narrow Range Inside 4

• PE_MktCap_Grwth

• Piercing Lower BB

• Piercing Higher BB

• RSI cross over 30

• RSI cross under 70

• Stochastic_OS_Xover

• Wide Range Outside 4

Click here to access our Sample Library of Market Screener Plus Filters.

Components of Filter Window

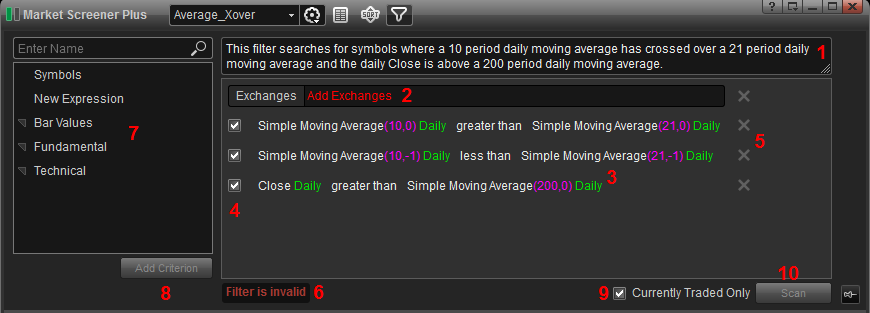

As an example, I have selected one of the default filters, the Average_Xover filter (displayed in Text Mode):

(1) This section is the description of the filter. A description can be added or edited.

(2) This section displays the selected exchanges.

(3) This section displays filter criteria. In the default text mode, numerical values are highlighted in magenta and time intervals are highlighted in green.

(4) Unchecking a box for a criterion temporarily excludes it from scam until it is checked again.

(5) Clicking on an X permanently removes the associated criterion.

(6) Warning message is displayed if the filter is invalid.

(7) Selection panel for scan criteria.

(8) Click button to add selected criterion.

(9) Checkbox to only include stocks that have traded during the current session.

(10) Click Scan button to start scan.

Creating a New Filter

To create a new filter, click the gear icon followed by New Filter.

You'll be prompted to add scan criteria from the menu on the left which include Symbols, Exchanges, New Expression, Bar Values, Fundamental, and Technical.

Adding Criteria to a Filter

You can add a criterion by either double left-clicking on the criterion, by left-clicking on it and dragging it into the selection area, or by selecting the criterion and click the Add Criterion button:

You can add a criterion by either double left-clicking on the criterion, by left-clicking on it and dragging it into the selection area, or by selecting the criterion and click the Add Criterion button:

Editing Criteria

After adding criteria, you can edit them by clicking the gear icon next to it. This will bring up window to edit the selected criterion, such as the High, in this example:

Interval: Desired time interval.

Bars Back: Which bar back from current bar is to be referenced.

Criteria Types

Symbols

This criterion will limit the scan to a set of user specified symbols, if desired. These symbols can be manually entered or you can copy and paste a list of symbols:

Exchanges

At least one exchange must be selected. Click the area highlighted below to specify which exchange (or exchanges) you wish to perform the scan on:

Once you've selected the exchange(or exchanges),click Apply.

New Expression

Allows you to combine criteria and create a mathematical relationship between them. Click here for additional information on the New Expression criterion.

Bar Values

• Close

• High

• Low

• Open

• Prev Day Close

• Volume

• Close

• High

• Low

• Open

• Prev Day Close

• Volume

Fundamental and Technical Filters

There's a list of 50 Fundamental fields along with 25+ Technical Studies that can be used as part of the scan filter. For additional info on these filter criteria, please click here.

After the filter criteria have been selected, click the Scan button (if Currently Traded Only is checked, then only issues that have traded during the current session will be included.

Results are displayed as a Watch List (a maximum of 1000 results can be displayed).

You can add columns with built-in studies, EFS formulas and any of the fundamental data fields available in the eSignal application by right-clicking anywhere on the column header bar and select Add Column. The following dialog box will appear:

The results can also be sorted:

Exporting the Results

To export results from the Market Screener Plus, right-click anywhere in the Screener window and select Data Export.

The Export Data dialog box will appear with a list of items which can be selected to be exported:

target: click the browse button  to select the location the file will be save to.

to select the location the file will be save to.

Export with Heading: Check the box if you want the column headings to be included.

Reverse Order: Check the box to export the symbol list in reverse order that appears in the Market Screener Plus.

Click the Export button and then the Close button when the export process is completed.

You can change the properties of the Market Screener Plus window either by right-clicking in the Window and selecting Properties, clicking Market Screener Plus on the main menu bar and selecting Properties, or by using by using a keyboard shortcut (Alt+Return).

The Properties dialog box displays the following selections:

Default Cell

Default Cell

The Default Cell menu allows you to specify the Font Type and Size along with a button for Bold and Italics. There are color settings which include Text and Background. Background #2 is checked if you prefer alternating colors for each row. Additionally you can edit the text and background colors for Triggered Alerts.

Symbol Field

Change fonts, colors, and toggle between displaying the symbol or description of the listed issues. Background #2 is checked if you prefer alternating colors for each row. You can select Show Symbol as Description which will display the description vs. the symbol. Checking the Show Description in the Tooltip checkbox toggles the displaying the description when you mouse-over a symbol.

Grid Lines

Use this menu to add vertical and horizontal grid lines and to customize the grid line color.

Focus Outline

Allows to set the outlining a row or cell when it is selected.

Direction

Changes the color and display of when a tick is up or down.

Color: Allows you to choose a column (Symbol, Last, Change, All Cells) for the color display which is based on Net Change. Green (Up) indicates a positive change, Red (Down) indicates a negative change, and Grey (Zero) indicates no change.

Tick Display: Allows you to toggle between using arrows or +/- for changes up and down.

The High/Low Highlight: This section enables the High, Low and/or Last, fields to be highlighted when a new session high or low value is hit.

Data

Configures whether the data displayed in the Market Screener Plus window will use the settlement price as the Close (futures) and also to adjust for dividends (stocks).

Configures whether the data displayed in the Market Screener Plus window will use the settlement price as the Close (futures) and also to adjust for dividends (stocks).

Rescan

Allows you to select to to auto refresh the scan and the frequency, if checked.

Trading Default Connections

Allows you to set the default trading connections for stocks for the Market Screener Plus window.

Allows you to set the default trading connections for stocks for the Market Screener Plus window.